Rising taxes mean UK households face several more years of falling living standards even though inflation is coming down, the Organisation for Economic Cooperation and Development said.

The Paris-based institute said in its biannual economic outlook that real wages will “finally grow” as pay outstrips prices, but “higher fiscal pressure will reduce household disposable income.”

The warning comes days after the government unveiled a £10 billion ($12.7 billion) cut to National Insurance Contributions, a payroll tax, which Chancellor of the Exchequer Jeremy Hunt hailed as part of “the biggest package of tax cuts since the 1980s.”

However, the overall burden is on track to hit a post-World War II high as a result of the decision to freeze personal tax thresholds from 2022 to 2028, the Office for Budget Responsibility forecasts.

The effect, known as fiscal drag, will raise about £30 billion more tax annually from households than the the government is giving back in NICs, David Miles, a member of the fiscal watchdog, told Parliament separately Tuesday.

Fiscal drag “erodes the real value of their earnings,” he said. “Their standard of living has declined as a result of this.” The OBR says real disposable income per person is in the grip of the biggest decline since the 1950s.

The OECD said the “fiscal pressure on households and businesses has increased significantly since the spring Budget, due to the freeze of income tax brackets and the corporate income tax rate increase.” The main levy on company profits rose to 25% from 19% in April.

A Treasury spokesperson said: “While the UK has the lowest tax burden of any major European economy, we had to take difficult decisions on tax to help pay off our Covid pandemic debt.”

“With inflation now falling, we are taking the long-term decisions needed for growth, which is why we have cut National Insurance contributions for 29 million working people, worth £450 for the average employee.”

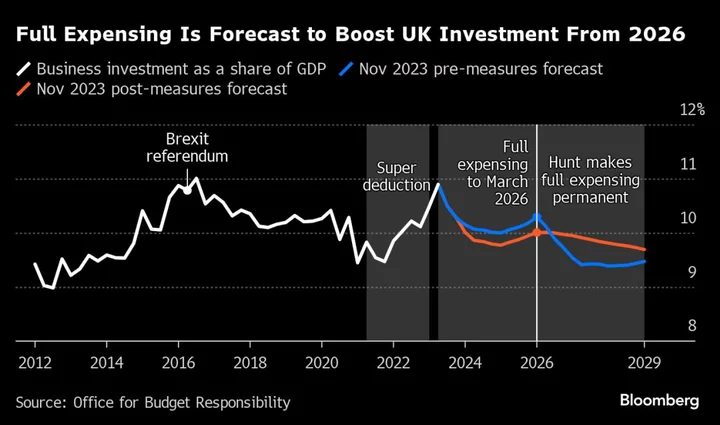

OECD Chief Economsit Clare Lombardelli, who used to be chief economist at the UK Treasury, welcomed both the NICs cut and the government’s £10 billion “full-expensing” tax break for companies, both announced in the Autumn Statement.

Lower NICs should encourage more people into the labor force, and full-expensing should boost business investment, the OECD said.

It also praised the government for its tight fiscal stance, reducing borrowing by 2% of GDP over the next two years. The consolidation “adequately supports monetary policy” in getting inflation back to the 2% target, it said.

For the three-year period from 2023 to 2025, UK GDP growth will be the second-slowest of all Group of Seven nations, just behind Italy and France, the OECD predicts. Germany will be weakest. The Treasury pointed out that the UK has grown faster than France, Japan, Italy, and Germany since 2010.

With the Bank of England appearing to rule out easing monetary policy anytime soon, the OECD expects interest rates to be held at 5.25% until “early 2025” and for core inflation to drop to 3.8% next year and 2.6% the year after. Rapid rate cuts to 4% are then expected by the end of 2025.

The OECD once again urged the UK government to drop the triple lock — a guarantee that the state pension will rise by the highest of inflation, earnings growth or 2.5% — and link it to an average of inflation and earnings.

It also warned that the public finances face significant risks over the next five years from higher pension spending, greater investment to decarbonise inudustry and homes, and lost fuel duty as petrol vehicles are replaced by electric ones.