Western automakers are set to lose a fifth of their global market share due to the unstoppable rise of more-affordable, cheaper-to-produce Chinese electric vehicles, according to UBS Group AG analysts.

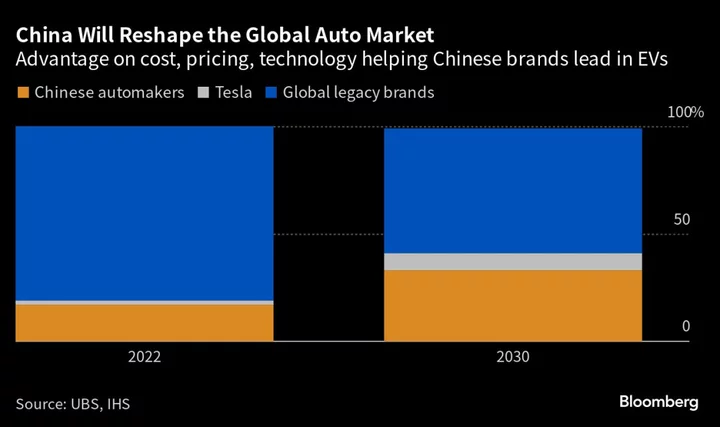

Led by BYD Co., Chinese carmakers will almost double their share of the auto market to 33% by the end of the decade, UBS analysts including Patrick Hummel and Paul Gong wrote in an Aug. 31 report.

Chinese manufacturers including Nio Inc. and Xpeng Inc. have ramped up their presence at this week’s IAA car show in Munich, and while German powerhouses Mercedes-Benz Group AG and BMW AG unveiled their next generation EVs, they won’t hit the market until 2025.

Read More: VW, Mercedes, BMW Show Up to Car Show Empty-Handed

“The global auto industry is going to undergo seismic changes over the next 10 years or so,” Gong, UBS’s head of China autos research, said in an interview.

The report predicted Western automakers’ global market share will slump to 58% from 81% by 2030.

“That would be a crisis moment for Western legacy companies,” Gong said.

Tesla Inc.’s share is likely to rise to 8% from 2%.

BYD, China’s biggest-selling auto brand, has a 25% cost advantage over North American and European brands, giving the Shenzhen-based company ample firepower to undercut rivals on their home turf as it expands globally.

A UBS teardown of a 2022 BYD Seal sedan found 75% of the components were manufactured in-house. The figure — double the global average — is the secret to BYD’s cost-advantage in its quest to control its own fully integrated supply chain. The Seal is almost wholly made in China, with around 10% or less of parts from foreign suppliers, UBS estimates.

“It’s really a showcase of Chinese engineers and engineering dividends,” said Gong, pointing to BYD’s 600,000-strong workforce — five times larger than Tesla’s — including 90,000 engineers.

BYD, which also makes its own batteries and semiconductors, has a 15% cost advantage over Tesla’s Chinese-made base Model 3 sedan, and a more than 30% advantage over Volkswagen AG’s ID.3, according to the UBS report. BYD dethroned Volkswagen as China’s top-selling car brand earlier in 2023.

Read More: Tesla Refreshes Model 3 and Slashes Prices of Top-End Cars

UBS’s predictions for the global auto market in 2030 are also notable for the view that Chinese automakers won’t be operating in the US — the world’s second-biggest car market — or have any material success in Japan, South Korea and India, which all have strong domestic incumbents.

The likes of BMW, VW and Mercedes, which all count China as one of their biggest markets, are speeding up their transition to EVs.

BMW unveiled a prototype of its Neue Klasse electric car at the IAA on Saturday. The two-door coupe has a digital display projected onto the width of the windscreen, as well as software that can process voice commands and hand gestures — functions that Chinese consumers have come to expect in EVs.

The shift away from a decades-old tradition of mainly advertising driving performance shows BMW’s determination to catch Chinese EV makers, said Yale Zhang, managing director of Shanghai-based consultancy Automotive Foresight.

Of the three big German luxury brands, BMW is demonstrating speed and focus on EVs, with sales of its battery-powered models in China leading Mercedes and VW’s Audi, Zhang said.

“BMW still needs to catch up to Chinese EV makers in intelligent driving solutions such as smart cockpit and autonomous driving,” he said. “But this concept car has shown a radical shift in its style and application of the smart cockpit. It’s one to watch.”