Sweden’s Riksbank is as likely to raise its benchmark rate as to keep it unchanged, and could take action if the krona weakens again or if there are other signs that inflation is picking up once more, said Governor Erik Thedeen.

The Swedish central bank this week left its benchmark rate unchanged at 4%, marking the first break in a tightening campaign that’s dented consumption and led to a plunge in housing construction in the Scandanavian country.

The Riksbank left the door open to further rate increases, signaling that it could hike again early next year. In an interview with Swedish Radio on Saturday, Theedeen said he saw a “fifty-fifty” chance of such a move.

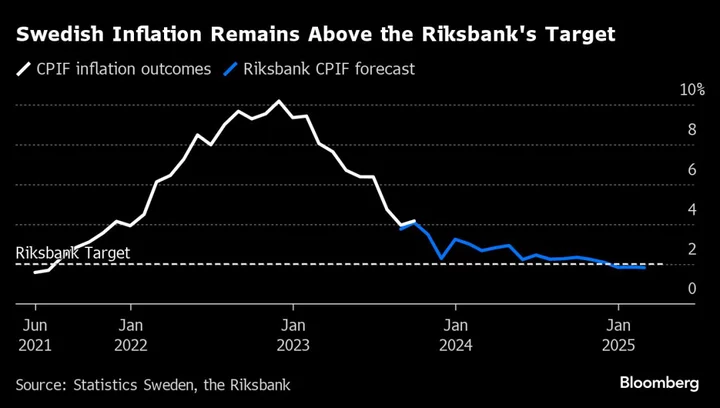

“The development for inflation appears to be improving, at the same time as risks remain,” Thedeen said. “We are buying some time to see whether that positive development is confirmed, or if there are further setbacks.”

Speaking on Thursday at a news conference, Thedeen said it was “very clear we have not lost the chance to hike again” if inflation doesn’t subside as hoped.

Read More: Riksbank Shirks From Rate Hike as Swedish Economy Stumbles

One development that’s encouraged the central bank is a strengthening of the krona, as its recent weakness has led to higher prices on imported goods. Thedeen said on Saturday that while the bank has no target for the exchange rate, a new bout of deterioration could force the Riksbank’s hand.

“The currency is a large risk factor and a setback for the krona could prompt us to increase the rate, simply because exchange rates are connected to inflation,” he said. “We have every opportunity to do that, already in January.”