After clearing up record losses and a toxic partnership, Renault SA Chief Executive Officer Luca de Meo is preparing his biggest bet on taking the French carmaker through the electric-car transformation.

Investors will this week learn more about the planned initial public offering of Renault’s EV and software arm targeting an ambitious valuation of €8 billion ($8.5 billion) to €10 billion. At a capital market day on Nov. 15, de Meo will pitch how he’ll overcome a difficult market for listings and catch up in the race for a European answer to Tesla Inc. and competition from Chinese manufacturers.

“We are working hard for the IPO but I am not a kamikaze,” de Meo said in an interview on the sidelines of an event in Paris last week. “I am not going to put it on the market at a discount.”

The former Audi and Fiat executive has guided Renault through rough times. Coming on board in 2020, the 56-year-old brought Renault “back from hell” which included state-backed loans to survive the pandemic and billions of writedowns from its significant Russian business. Months of painstaking talks to loosen ties with its by now tense 24-year-old alliance with Nissan Motor Co. was next.

Renault, which is set to reveal a second affordable EV this week, aims to list Ampere in April or May next year, a plan hampered by a price war kicked off by Tesla and shaky IPO performances from chip designer Arm Holdings Plc and sandal maker Birkenstock Holding Plc. But options for the Europe-focused mass-market carmaker are dwindling for the next phase of the costly EV transition.

“Luca has a roadmap, he gave Renault a direction and the quality of Renault cars is amazing these days,” says Pierre-Olivier Essig, an analyst at AIR Capital in Geneva. “The IPO may not be a great idea right now, given where markets stand, but ultimately I think Luca will succeed.”

After being sidetracked with the thorny Nissan relationship and shock departure of former alliance leader Carlos Ghosn, Renault needs to speed up to catch rivals like Stellantis NV, the company formed from the merger of France’s PSA Group and Fiat Chrysler. Carlos Tavares’ 14-brand behemoth now towers over Renault with superior synergies after Renault’s own plan to merge with Fiat faltered.

Read more: Renault Seeks Margin Boost From Sweeping Overhaul Plan

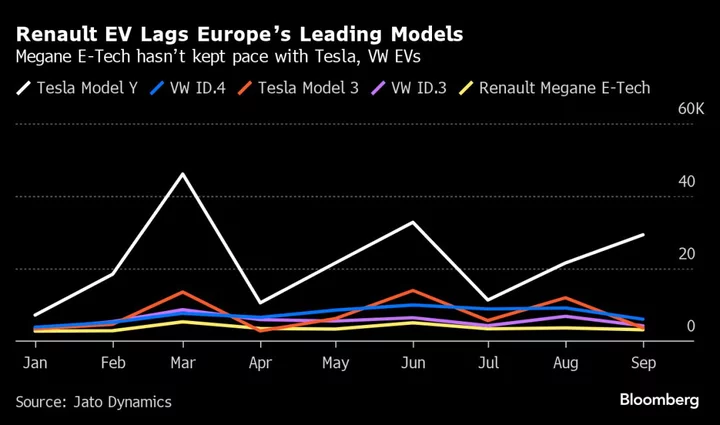

So far, the carmaker’s electric push is plodding. The group has lost EV market share in a group of 28 European countries this year due to the phasing out of the Zoe, a top-seller among the industry’s initial wave of electric models, according to Jato Dynamics.

Sales of the Megane E-Tech — which Renault hoped would rival Tesla’s Model 3 — have been slow at about 35,000 vehicles through the end of September, short of an initial internal target of over 100,000 cars per year, and the Ampere IPO has already been pushed back once.

The IPO would allow Ampere to go faster in its ambitious development plan at a time when speed of innovation counts. Aside from the Megane E-Tech, there’ll be five more Renault brand EVs by 2030, including the Scenic and new Renault 5.

“The group is in dire need of new products to better compete against VW Group, which has 15 models available as of today, and Stellantis, which offers 23 models, including vans,” said Felipe Munoz, global analyst at Jato Dynamics.

De Meo has other funding options: Renault has cash and it could to sell part or all of the Nissan shares, recently transferred into a trust, that are currently worth $4.8 billion — though any such move will done in close concert with its partner.

He wants to attract new investors in the share sale and may shelve it below a valuation of roughly €8 billion, according to two people familiar with the situation, who asked not to be identified discussing internal matters.

“Ampere is a project for the long term and the IPO is one piece of the puzzle, de Meo said.

Worries that de Meo is adding too much complexity while being off to a difficult start with the pricey Megane E-Tech is casting a pall over the IPO.

“It’s simplistic to say that the Ampere IPO won’t work because there haven’t been enough Megane E-Tech cars sold,” he said. “It was never meant to be a volumes car and we sold thousands of Dacia Spring and Zoe EVs in past years.”

Central to Renault’s IPO pitch will be its software capabilities, which the company rates as superior after snapping up more than 400 Intel Inc. software engineers in 2017. The team helped win over partners like Qualcomm Inc. and Alphabet Inc.’s Google and steered the carmaker around some of the software pitfalls of bigger rivals, according to de Meo.

The French state, a key shareholder with a 15% stake, sees the same logic for splitting off EV operations and becoming a public company.

“The new EV entity will help develop a new culture,” said Alexis Zajdenweber, a French government representative on Renault’s board of directors. The new unit will be “closer to the tech ecosystem and the innovative mindset suited for a leading EV manufacturer.”

--With assistance from Craig Trudell.