New Zealand’s central bank can’t afford to ignore a surge in immigration, even though it’s expected to subside next year, because inflation has been above target for so long, Deputy Governor Christian Hawkesby said.

“When you’re an environment where inflation’s at target and inflation expectations are really well anchored, you’ve got the luxury to look through things and bide your time,” Hawkesby said in an interview Friday in Wellington. “When inflation’s above target, has been above target for a prolonged period and core inflation pressures are slow in terms of coming back to target, you don’t have that luxury.”

The Reserve Bank kept the Official Cash rate unchanged at 5.5% this week but surprised markets by signaling a greater risk of a hike next year, citing New Zealand’s strong population growth after the reopening of the border in the wake of the pandemic. Policymakers said they’re concerned that the flood of new arrivals is pushing up rents and house prices, and may add to inflation pressures.

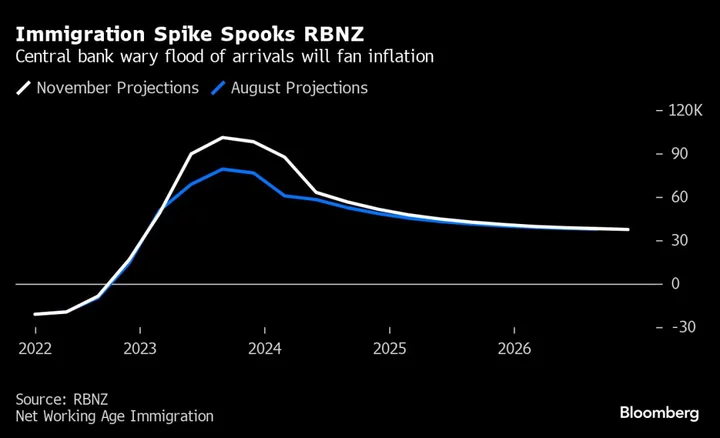

The RBNZ had initially viewed rising immigration as less of an inflation risk because it was alleviating a labor shortage and reducing upward pressure on wages. But Hawkesby said the spike has been bigger than expected and is now fueling demand.

“Net migration has peaked at higher levels, so that’s news in itself, important news,” he said. “What we’re seeing now become more evident is those demand-side impacts coming through. The fact you have got to house a bigger population and the impact that that has, particularly on rental inflation and things like that.”

The New Zealand dollar extended gains after the comments were published, rising more than a quarter of a US cent to as much as 61.92 cents, a four-month high.

More People

New Zealand’s population rose 2.7% in the year through September, its biggest jump in more than 30 years, as net annual immigration surged to a record 118,835.

The RBNZ projects annual working-age immigration will tail off from a peak of more than 100,000 to about 51,000 by the end of 2024, though Hawkesby said “there’s still a lot of uncertainty about what that path will actually look like.”

The rate of inflation, currently 5.6%, is projected to return to the RBNZ’s 1-3% target by the third quarter of 2024. But the bank’s raised forecast track for the cash rate doesn’t envisage cuts until mid-2025, when it expects inflation to be close to its goal of 2%.

Asked why the RBNZ would wait so long to cut rates, Hawkesby said the bank needs to be sure that inflation expectations are well anchored again. The economy has also been through a period of overheating and now needs to spend time cooling with a negative output gap, he said.

Despite the RBNZ’s hawkish tilt, markets continue to price rate cuts next year.

Hawkesby said the bank doesn’t measure success by short-term market reactions, “and sometimes it takes a little while for these things to sink in.”

“The feedback that we are getting from the market is that our communications have been genuine and clear,” he said. “That’s useful because it means people are really clear about our reaction function and if things do evolve, which way we’re likely to be leaning.”

He also noted that there’s a lot happening in markets internationally that could be influencing the way investors are seeing the RBNZ.

“Globally the main game in town is trying to pick when the first cut is and who’s going to be the first one to cut interest rates,” Hawkesby said.

The bank was cognizant of the market’s rate outlook diverging from its own prior to this week’s policy decision, he said.

“There was a wedge there between what our central projections are telling us about the likely outlook and where markets were pricing,” Hawkesby said. “And that’s why we probably spent more time laying those issues out” in the policy documents “so that it was very clear what was driving those differences.”

Largely, that was around “the importance of population growth,” he said.

--With assistance from Matthew Burgess.

(Updates with kiwi dollar reaction in sixth paragraph)