Australia’s incoming central bank deputy governor may draw on his background as an architect of the Bank of England’s active bond sales to revive discussion about quantitative tightening at his new employer, according to Deutsche Bank AG.

Andrew Hauser, named this week as the Reserve Bank’s No. 2 official, was previously executive director for markets at the UK central bank. He “brings to the RBA first-hand knowledge of the BOE’s vastly deeper experience with quantitative easing / tightening programs,” said Phil Odonaghoe, economist for Australia at Deutsche.

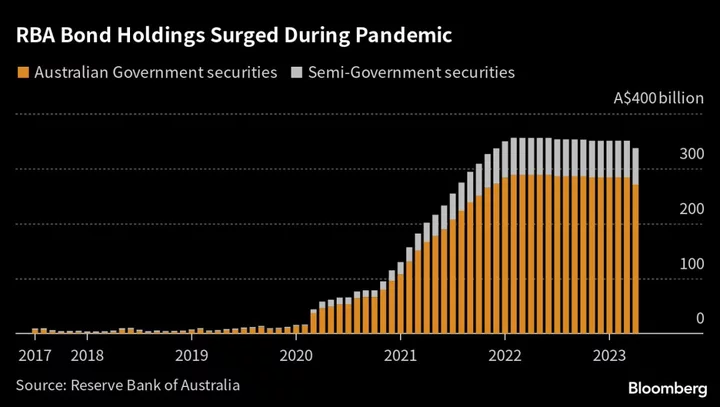

While the RBA has run a “hold to maturity” policy for its pandemic-era bond holdings, the BOE has been actively selling paper since November last year, with about a £10 billion ($12.7 billion) per quarter sale schedule, Deutsche said.

Odonaghoe highlighted two features of the BOE’s bond experience that might guide Hauser’s approach to the RBA’s current policy.

- Having a lean balance sheet, unburdened by legacy programs, may be a prudent starting point, Odonaghoe said. That is a lesson the BOE may have learned the hard way during Covid after it failed to sell down holdings built up during the global financial crisis, he said

- Passive QT is choppy and slow. Relying on holding to maturity alone, the RBA’s holdings will take a long time to unwind. Some 8% of BOE bond holdings were scheduled to mature in 2022 and 2023, compared with 6% for the RBA, Odonaghoe said. Indeed, under the RBA’s current policy, the bond holdings aren’t scheduled to be fully unwound until 2033

“Hauser will take up his role at the RBA sometime in the new year,” Odonaghoe said. “Given his experience, we think the chance of a shift to active RBA bond sales some time in 2024 has increased.”