Australia’s central bank chief said taming consumer prices remains a “crucial challenge” for policymakers after they resumed raising interest rates two weeks ago to ensure inflation expectations remain contained.

“Inflation is a crucial challenge over the next one to two years,” Reserve Bank Governor Michele Bullock said on a panel discussion in Melbourne on Tuesday. “Inflation at the moment really is all a supply driven thing. Petrol prices, rents, these sorts of things, energy, but there’s an underlying demand component to it as well. And that’s what central banks are trying to get on top of.”

She spoke as minutes of the RBA’s Nov. 7 meeting showed that policymakers ended a four-meeting pause to make sure that inflation remained on track to return to its 2-3% target in the face of faster economic growth and a stronger labor market.

“Members assessed that tightening monetary policy at this meeting would help to mitigate the risk of an unwelcome rise in inflation expectations,” the RBA said in the minutes released in Sydney on Tuesday. It cited a scenario where “even a modest further increase in inflation expectations would make it significantly more challenging and costly to return inflation back to target within a reasonable timeframe.”

The RBA lifted borrowing costs to a 12-year high of 4.35% this month as inflation shows signs of stickiness and the economy proves more resilient to tighter monetary policy. It indicated that further rate rises will depend on inflation and employment data and how the global economy evolves.

Australia’s jobless rate climbed to 3.7% in October as more people sought work, while the economy continued to add jobs. Unemployment has hovered in a 3.4%-3.7% range since June last year.

The RBA expects inflation will only return to the top of its target in late 2025 and officials have indicated that the next stage of bringing down consumer prices is likely to be more “drawn out.”

It reiterated that view on Tuesday: “it was expected to take longer to return inflation to target than it had taken so far to reduce inflation from its peak.” It said its inflation forecasts are based on assumptions of one-to-two more interest rate increases.

Many economists including at Commonwealth Bank of Australia now predict the RBA has probably finished hiking, though National Australia Bank and Royal Bank of Canada are among a handful that see at least one more hike to 4.6%.

Further Tightening

“Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe would depend on how the incoming data alter the economic outlook and the evolving assessment of risks,” the minutes showed.

The board did discuss the possibility of a pause two weeks ago, which would’ve seen the bank stand pat for a fifth consecutive meeting, highlighting that inflation was decelerating and the geopolitical and economic outlook was “highly uncertain.” However, it decided the case to hike was stronger.

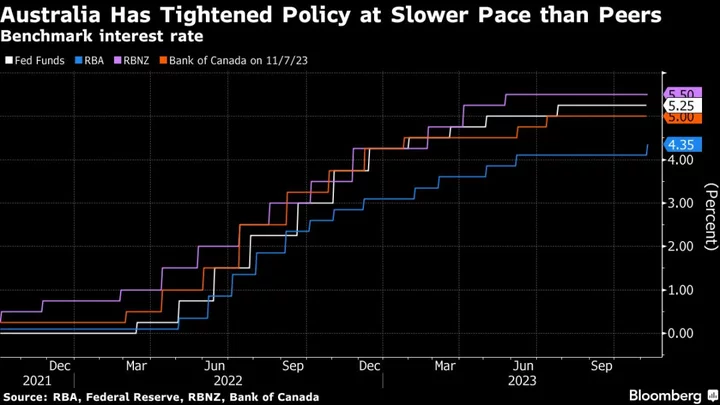

The board noted that Australia’s cash rate remained below policy rates in many other countries “despite similar economic conditions.” The RBA has boosted borrowing costs by 4.25 percentage points in the current campaign, compared with 5.25 points in the US and New Zealand.

Staff estimates showed that required household debt repayments as a share of disposable income indicated that “the debt repayment burden was not as high as it had been 15 years earlier,” the minutes said. The board also noted that borrowers with fixed-rate loans rolling off to higher market rates were doing so “without a noticeable adverse effect” on their ability to service loans.

Australia’s housing market has staged a surprising turnaround, rising for consecutive months since February amid the combined effects of high demand buoyed partly by strong population growth and limited supply. In addition, construction activity continues to be limited by capacity constraints because of labor shortages and a tightening of financial conditions.

The central bank said that the rebound in the property market and an increase in loan approvals “might indicate that financial conditions are not especially restrictive.”

--With assistance from Amy Bainbridge and Chris Bourke.

(Adds Governor Bullock from lead.)