Qualcomm Inc., the largest maker of smartphone processors, gave a tepid revenue forecast for the current period, indicating that demand for mobile devices remains weak even as the industry emerges from a glut.

Sales will be $8.1 billion to $8.9 billion in the fiscal fourth quarter, Qualcomm said Wednesday in a statement. The midpoint of that range is well below the $8.79 billion average analyst estimate. Minus certain items, profit will be $1.80 to $2 a share, compared with a $1.94 projection.

The shares slid about 2% in late trading after the report was released.

The outlook renews concerns about a smartphone industry contending with its worst downturn in years. Qualcomm and its chipmaking peers saw a steep drop in orders from handset makers, which suddenly had more inventory than they needed. Even Apple Inc.’s prized iPhone suffered a slowdown, contributing to a broader sales decline at the company.

While chip inventory is now approaching more normal levels, growth will likely prove elusive until consumers start showing more appetite for new phones.

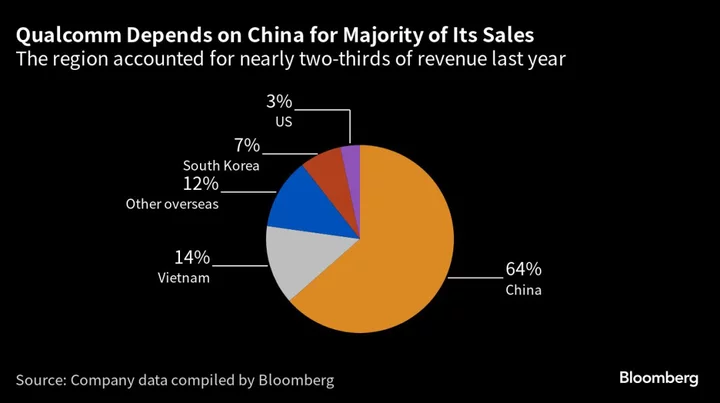

Qualcomm also said that demand in China, the biggest market for phones, hasn’t returned to projected levels. That region provides the company with more than 60% of its sales.

Chief Executive Officer Cristiano Amon is working to make his company less dependent on an unreliable smartphone market. The San Diego-based company is now selling more chips for cars, networking, computing and wearable devices, but it still gets more than half of its revenue from the handset industry.

The company’s main product is a processor that runs many of the world’s best-known phones. It also sells the modem chips that connect Apple’s iPhone to high-speed data networks. An additional chunk of Qualcomm’s profit comes from licensing the fundamental technology that underpins all modern mobile networks — fees that phone makers pay whether they use Qualcomm-branded chips or not.

Before the earnings report, Qualcomm’s stock had increased about 18% this year. That underperformed a broader rally for the chip industry, with the Philadelphia Stock Exchange Semiconductor Index gaining about 47% in 2023.

In the fiscal third quarter, which ended June 25, profit was $1.87 a share. Revenue fell 23% to $8.45 billion. Analysts had estimated profit of $1.81 and sales of $8.51 billion.

Phone-related sales were $5.3 billion, compared with an average estimate of $5.48 billion. Automotive revenue rose from a year earlier to $434 million, short of an estimate of $448 million. Sales from connected devices were in line with estimates at $1.5 billion.