Qualcomm Inc., the largest seller of smartphone chips, gave a better-than-expected revenue forecast for the current quarter, indicating that the mobile-phone industry’s inventory glut may finally be receding.

Sales will be $9.1 billion to $9.9 billion in the fiscal first quarter, Qualcomm said Wednesday in a statement. The midpoint of that range — $9.5 billion — was well ahead of the average analyst estimate of $9.26 billion, sending the shares higher in late trading.

Wednesday’s report offers a glimmer of hope that consumers are finally beginning to upgrade their phones again. Many shoppers — especially in China — have been holding on to existing models for longer than in the past, hurting demand for Qualcomm’s chips. A rebound would buoy the company’s main source of revenue.

Most excess inventory has now been cleared out, and the company expects revenue from Chinese phone makers to jump 35% in the current period from the preceding three months.

Qualcomm shares gained 4% in extended trading after the report was released. They had been little changed this year, underperforming a broad rally in semiconductor-related stocks.

Excluding certain items, profit will be $2.25 to $2.45 a share in the current quarter, Qualcomm said, versus an average projection of $2.25.

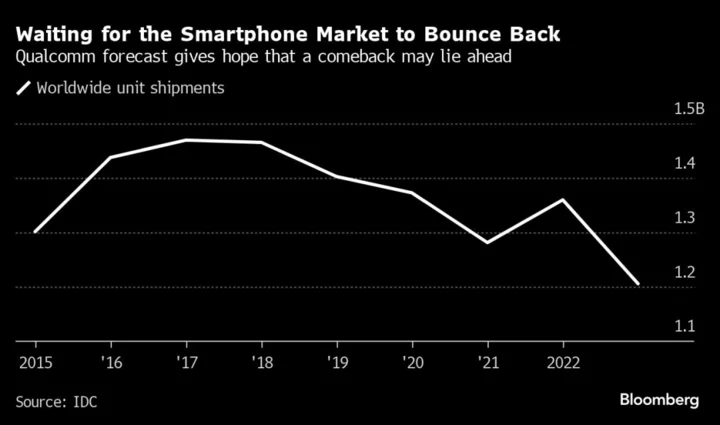

For now, phone demand remains slow. Handset shipments will decrease by a percentage in the mid-to-high single digits this year compared with 2022, “which is an improvement from what we had before,” Chief Financial Officer Akash Palkhiwala said on a conference call with analysts.

In the fiscal fourth quarter, which ended Sept. 24, profit fell to $2.02 a share. Revenue declined 24% to $8.63 billion. Analysts had estimated profit of $1.92 and sales of $8.51 billion.

“We’ve seen stabilization in the market,” Palkhiwala said. Some of that improvement stems from customers building up their inventory to a normal level, he said.

In the fourth quarter, handset and connected devices revenue declined in line with what Wall Street had projected, while automotive revenue exceeded predictions. Handset related sales were down 27% to $5.46 billion. Chips for internet-connected devices slid 31% to $1.38 billion, while automotive sales jumped 15% to $535 million.

For the current period, Qualcomm is projecting sales of $7.7 billion to $8.3 billion for its chip business. That’s ahead of the $7.8 billion average estimate.

As promised, Qualcomm has reduced its workforce to cut expenses. Last month, the company told California regulators that it’s eliminating 1,258 positions in San Diego and Santa Clara, California. A Qualcomm hasn’t commented on the overall size of the reductions to its 50,000-member workforce.

Chief Executive Officer Cristiano Amon is working to make his company less dependent on what’s become a more competitive and slower-growing market. Stepping up a long-running effort to break into personal computer components, Qualcomm unveiled a new laptop processor designed to outperform rival products from Intel Corp. and Apple Inc. The new Snapdragon X Elite is as much as twice as fast as a similar 12-core processor from Intel, while using 68% less power, Qualcomm claims.

Amon also commented on reports that Nvidia Corp. and other companies are pushing into the PC market, using chip designs from Arm Holdings Plc — the same fundamental technology that Qualcomm uses. That news should be seen as affirmation that Qualcomm is making the right bet, he said. Future personal computers also will run more artificial intelligence software, something Qualcomm has anticipated in the design of its products, he said.

The San Diego-based company’s main product is a processor that runs many of the world’s best-known phones. It also sells the modem chips that connect Apple’s iPhone to high-speed data networks.

An additional portion of Qualcomm’s profit comes from licensing the fundamental technology that underpins all modern mobile networks — fees that phone manufacturers pay whether they use Qualcomm-branded chips or not.

(Updates with executive comments starting in eighth paragraph.)