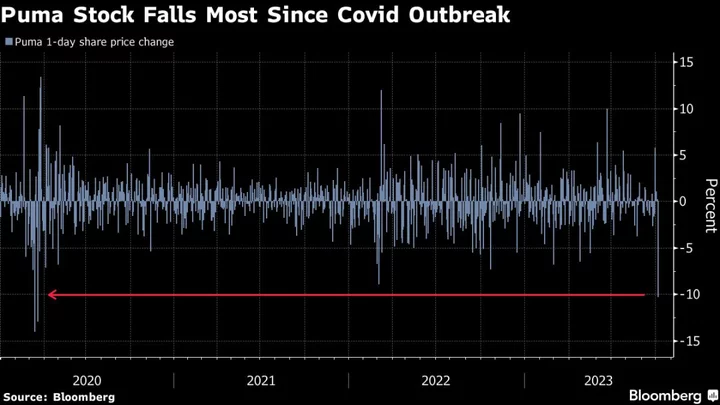

Puma SE shares had their biggest intraday drop in more than three years after the sportswear company’s comments on a call with analysts spurred worries about sales.

The shares fell as much as 12% in Frankfurt, the most since the Covid-driven market rout of March 2020, as Puma held a pre-‘blackout period’ discussion with analysts ahead of results that are due to be published on Oct. 24.

Piral Dadhania, an analyst at RBC Capital Markets, warned that the top end of Puma’s prior earnings guidance for 2023 “may be out of reach.” Dadhania expects North America revenue to be down 10% in Puma’s fiscal third-quarter, year-on-year, while growth in Europe has moderated, he warned.

“We do not comment on share price movements, but we are fully on track to achieve our full-year guidance,” a Puma spokesperson said by email.

The comments also hit apparel firms Adidas AG and Hugo Boss AG, which fell 3.5% and 2.0%, respectively. UK sneaker retailer JD Sports Fashion Plc fell 2.8%.

Puma was down 11% to 53.24 euros a share in late trading.