Risky private credit lending is vulnerable to higher interest rates and debt crunches, according to watchdogs across the globe that are seeking more transparency from the industry.

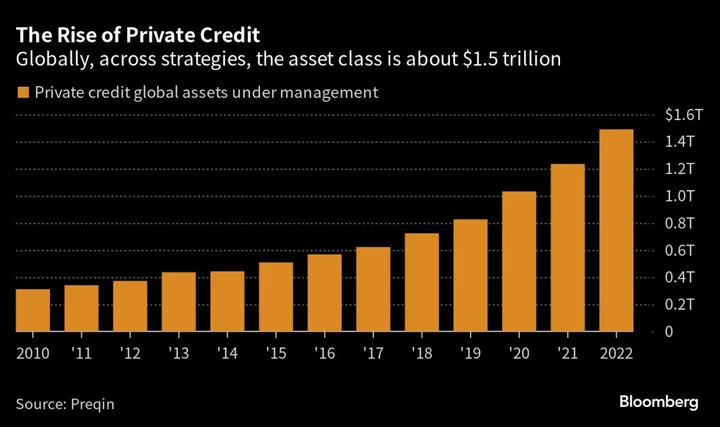

The International Monetary Fund weighed in on the risks to financial stability from the fast-growing $1.5 trillion asset class, saying transparency needs to improve and that more data needs to be collected, including on cross-border exposures.

Private credit is a “prominent” example of a market “susceptible to substantial corrections because of the lagged effects of higher interest rates,” the IMF said in a report on Tuesday. “Vulnerabilities” in that market, among others, could “pose risks to banks” as well as other lenders.

The warnings come after Moody’s Investors Service said last month that competition among banks and direct lenders for deals in the leveraged buyout space will likely result in more defaults. Any race to the bottom on terms and pricing could have wider systemic risk implications, the ratings company said. Parts of the US private credit market have used greater leverage to boost returns, meaning the threat there could be more substantial, the Bank of England warned in July.

“The industry has been growing quickly and it’s attracting attention because it’s now an important part of the economy,” said Stuart Brinkworth, a partner at legal firm Mayer Brown. “But regulators struggle to understand the asset class and because of that the inclination is to assume that more regulation must be the answer.”

Private credit, dominated by the likes of Blackstone Group and Ares Management Corp., boomed as heavier regulation saw banks retrench after the financial crisis, opening up an opportunity for direct lenders. They’ve been particularly active in leveraged buyout loans, taking advantage of the massive growth in mergers and acquisitions by private equity firms over the past decade.

The asset class is safer than its reputation for opacity suggests, executives at the lenders say, because money managers who invest in the funds know the risks and their exposure to the asset class is usually a small fraction of their wider portfolio. Investors in the funds are typically tied up for years, meaning they can’t just withdraw their money on short notice.

Still, some watchdogs are proactively introducing new measures to limit the possibility of contagion during periods of market turmoil.

The BOE, for example, plans to develop a permanent backstop facility for non-banks, including investment vehicles, which typically encompasses private credit. The facility would be available in times of stress to alleviate any risks to financial stability.

Earlier this year, the European Union reached an agreement on new rules for private debt funds and other alternative asset managers that will require them to enhance liquidity management. That will aid any fund managers dealing with large outflows during times of financial turbulence, according to the July statement.

“We believe the EU will be the outlier,” said Jiří Król, deputy chief executive officer at the Alternative Investment Management Association. “Most global jurisdictions will steer clear of imposing prescriptive rules of this kind on private credit funds.”

If more regulations are introduced, then the biggest impact is likely to come in the form of costs and lower returns rather than changes to deal sizes or structures, insiders say.

“More regulation and more administrative burden is going to cost money and it’s likely that investors will primarily be the ones to bear that cost,” said Art Penn, the founder of PennantPark Investment Advisers, which oversees about $6.6 billion.

Week in Review

- Private credit lenders are in talks to provide around $2 billion of debt financing to support a potential buyout of CCC Intelligent Solutions Holdings Inc., a car-insurance software provider.

- Two of the world’s biggest private credit firms have launched funds that will take far less profit than is usual for the industry — another sign of how power has started shifting toward investors in this $1.5 trillion market.

- Private credit managers are quietly providing record loans to existing borrowers seeking small acquisitions, stealthily building the value of their lending portfolios while adding more concentrated risks.

- Antares Capital is weighing an acquisition of European rival Hayfin Capital Management, a combination that would create a new private credit behemoth.

- HSBC is considering whether to enter Europe’s $300 billion collateralized loan obligation market as an arranger.

- Private lenders are seeing an uptick in demand for niche capital relief trades, according to Magnetar Capital’s David Snyderman.

- A handful of European companies have stepped away from their plans to sell junk debt recently, underscoring the difficulty of trying to navigate turbulent markets.

- Europe’s booming leveraged loan market just had a reality check with the first halted transaction since a global banking crisis upended markets back in March.

- A lender-appointed receiver has taken steps to assume control of a Byju’s unit in Singapore following months of failed negotiations with what was once one of India’s hottest tech startups.

- Indian conglomerate Hinduja Group is in talks with private credit funds to raise about $800 million to back the acquisition of Reliance Capital.

- Private credit investments in India could double in the next two years, the head of BPEA Credit Group forecasts.

- Hillhouse, the investment firm started with backing from Yale University’s endowment, is preparing to pitch a new Asia-focused private credit fund to international investors.

On the Move

- Khalid Krim, head of Credit Suisse’s EMEA debt capital markets desk, is leaving the bank after five years.

- Monarch Alternative Capital has hired Karan Malhotra as its head of structured credit trading.

- David Bourne, a managing director on the investment grade syndication and origination debt capital markets desk at TD Securities, is leaving the bank.

- HSBC Holdings Plc is assembling a team of bankers to connect its corporate clients with the rapidly expanding world of private credit.

- Bank of Nova Scotia recently hired three bankers from HSBC Holdings Plc in Canada to beef up its fixed-income syndication and trading desks.

- James Keller is joining Goldman Sachs in early December in its structured finance division.

- BNP Paribas SA hired two bankers who previously worked at Credit Suisse to join its credit desks.

--With assistance from Dan Wilchins.