The $1.5 trillion private credit market just set a fresh record for the largest loan in its history. With growing firepower, direct lenders are poised to take ever more deals away from banks and from the junk bond and leveraged loan markets.

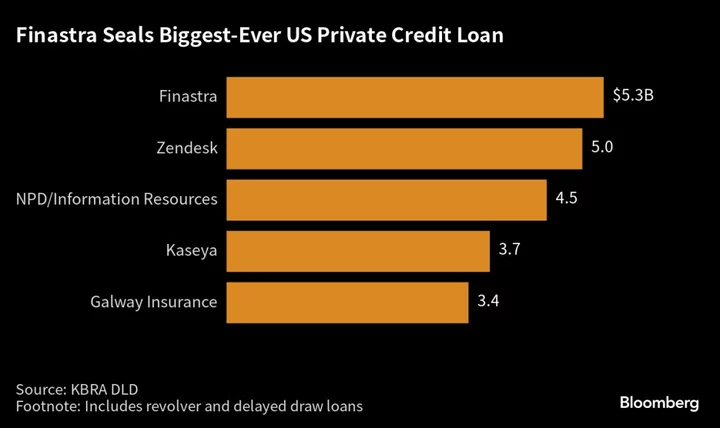

Private lenders such as Oak Hill Advisors LP, Blue Owl Capital Inc. and HPS Investment Partners LLC are providing a $5.3 billion loan package to Finastra Group Holdings Ltd., a fintech firm owned by Vista Equity Partners. Comprising a $4.8 billion unitranche, a blend of senior and subordinated debt, and a $500 million revolver facility, the financing is the biggest private credit loan ever in the US, according to data by KBRA DLD.

It’s been a dramatic rise. Even as recently as four years ago, a $1 billion private loan was a rare event and anything above $2 billion was simple aspiration. And back then, few borrowers who could tap the junk debt markets would opt instead for a private loan.

But with banks still reluctant to commit capital to risky loans, borrowers have been flocking to direct lenders.

Read more: Apollo and Blackstone Are Stealing Wall Street Loan Business

Now Finastra has exceeded the record set by Zendesk Inc. a year ago with its $5 billion bundle of private debt. And private lenders and Wall Street banks are engaged in a furious battle to win over financing deals.

The fresh record underscores the growing heft of the private credit market, which saw fundraising rebound last quarter, crops of new entrants and aspirations to score ever larger piles of cash.

What sets Finastra apart from many of the recent jumbo deals is the use of proceeds. The loan for Zendesk, an unused $5.5 billion package for Cotiviti Inc. and $3.4 billion for Galway Insurance all served to finance buyouts. But Finastra’s loan refinances existing debt that the company raised in the US and European leveraged loan market.

That’s a reflection of the collapse in mergers and acquisitions, and especially leveraged buyouts, triggered in part by the surge in interest rates over the past year.

“For non-levered buyout sponsor backed deals, we have been working on different short-term refinancing opportunities that offer a single solution that is easy and at scale,” said Mike Patterson, a governing partner at HPS. “This can allow a company to delay selling itself for when the M&A market has normalized and valuation expectations are better aligned.”

Deals

- Blue Owl and Oak Hill are providing a record $4.8 billion fully funded direct loan as part of Vista’s refinancing of fintech firm Finastra’s debt

- Apollo is poised to sign more than $4 billion in so-called NAV loans to private equity firms looking to raise cash in a challenging high-cost environment

- Qualitas Ltd. has obtained an additional A$750 million ($483 million) to be incrementally invested in Australian commercial real estate via private credit

- TPG has lined up a group of private credit funds led by Ares to help finance its acquisition of Australian funeral home operator InvoCare Ltd., with a A$800 million ($521 million) of debt

- Sixth Street acted as agent in a financing to Carlyle’s portfolio company HireVue with $310 million facility

Track the largest deals in the industry with our Private Credit Loan Monitor.

Fundraising

- Oaktree is looking to raise more than $18 billion in what would be the largest-ever private credit fund

- Blackstone Inc. raised $7.1 billion for a fund to finance solar companies, electric car parts makers and technology to cut carbon emissions

- Guggenheim Investments is seeking to raise at least $1.5 billion for its newest private credit fund

- KKR is continuing its push into asset-based financing with the launch of KKR Asset-Based Income Fund, in which it has raised at least $425 million

Job Moves

- After decades running and regulating banks, Joseph Otting has moved on to a booming Wall Street credit sector

- Sandeep Chandak is joining Hillhouse’s private credit business from Varde Partners

- Cresset has hired Bradley Schneider as managing director and head of private credit who was most recently head of private credit at Midwest Holding

Did You Miss?

- Omers Plots Bigger Move Into Credit on Richest Yields In Decades

- Latin America Startups Turn to Venture Debt as Equity Dries Up

- Ares Weighs Loosening Crystal Palace Ties to Focus on Chelsea

- Alternative Managers Rewrite Rules for Expanding Private Credit

- Private Lenders Take Control of More Companies as Rates Surge

--With assistance from Paula Seligson.