Jerome Powell will be in the Capitol Hill spotlight a week after the Federal Reserve paused its most aggressive tightening campaign in decades, with investors watching for clues on whether central bankers are indeed leaning toward further interest-rate hikes.

The Fed chair will deliver the central bank’s semi-annual monetary policy report to the House on Wednesday and the Senate the following day. Separately, three Fed nominees face potentially contentious confirmation hearings.

Powell is likely to face questions over the Fed’s decision to take a break after 10 straight interest-rate increases as it evaluates how the economy is responding to higher borrowing costs and recent banking stress. The decision was puzzling to many, since officials’ latest median forecast shows the benchmark rate rising to 5.6% by year end, compared with their March projection of 5.1%.

Democrats may applaud the Fed for taking a breather and remind Powell that overdoing the rate hikes risks pushing millions of Americans out of work. Republicans could hammer home the message that inflation is still too high, causing pain for households and small-business owners. And both sides may pressure Powell to explain how the central bank plans to improve financial supervision after the failure of several regional banks this year.

On Wednesday, Fed Governors Philip Jefferson and Lisa Cook, and nominee Adriana Kugler, currently the US representative to the World Bank, face members of the Senate Banking Committee as part of their confirmation process.

Jefferson, who garnered bipartisan support when first nominated for a board seat, was tapped by President Joe Biden to be promoted to Fed Vice Chair. Kugler would be the first Latina to serve on the Fed’s Board of Governors, and Cook was re-nominated since her current term expires early next year.

What Bloomberg Economics Says:

“Powell has another opportunity to convince the markets he’s not a closet dove — but it will be harder after June’s pause spoke volumes. That the FOMC didn’t hike even as they sharply revised up inflation and economic growth forecasts — with the majority of the committee now foreseeing no recession — suggests members either are more tolerant of higher inflation or lack confidence in the economy’s resilience.”

—Anna Wong, Stuart Paul, Eliza Winger and Jonathan Church, economists. For more, click here

The US data calendar is relatively sparse in a holiday-shortened week and includes several housing-related reports. Government figures on Tuesday are expected to show little change in May housing starts and an increase in applications to build. Homebuilder sentiment figures for June will be released a day earlier.

On Thursday, the National Association of Realtors will issue May existing-home sales figures. Economists project contract closings eased as the industry grapples with limited listings in a higher interest rate environment. Investors will also watch weekly jobless claims data for signs of softening in the labor market.

- For more, read Bloomberg Economics’ full Week Ahead for the US

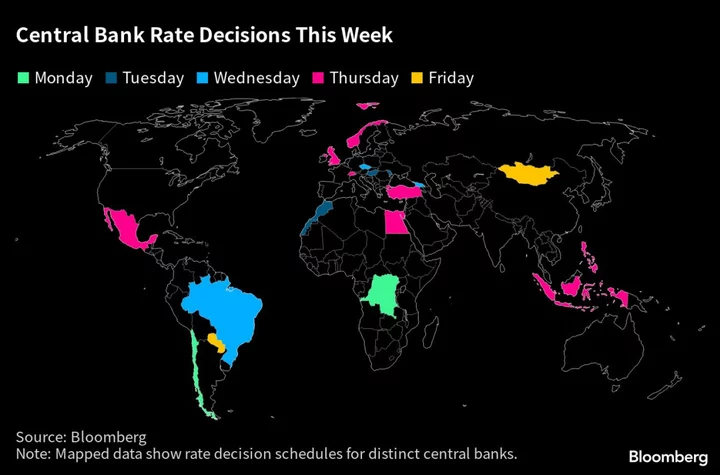

Elsewhere across the world, continued tightening by central banks in the UK, Switzerland and Norway, and a possible huge rate hike by Turkish officials, will be among the highlights. The Bank of Canada will reveal a summary of the deliberations that led to its surprise rate increase last month.

Click here for what happened last week and below is our wrap of what’s coming up in the global economy.

Europe, Middle East, Africa

Scheduled remarks by European Central Bank’s officials may draw attention after their decision to raise borrowing costs and pledge further tightening.

A week of intense monetary action is in store elsewhere, with the Bank of England on Thursday a standout. Its announcement will be revealed the day after UK data that may show inflation is still running more than four times officials’ 2% target. With price pressures untamed, a quarter-point rate increase is widely anticipated.

In Switzerland, where inflation is much closer to 2%, the Swiss National Bank is still likely to raise borrowing costs by 25 basis points on Thursday as it catches up with tightening in the neighboring euro region.

Officials will also release their annual financial stability report, which may make for interesting reading after the failure of Credit Suisse Group, the country’s second-biggest bank, in March.

Norges Bank may keep tightening the same day as well. Another hike of at least a quarter point was flagged at the previous decision in May, though local economists are increasingly expecting a half-point hike after stronger-than-forecast Norwegian underlying inflation and an improving economic outlook.

The future rate path will focus economists, as well as any comments on the krona, which officials already cited last month as a key factor to keep an eye on.

Turning east, Hungary’s central bank on Tuesday may cut the European Union’s highest key rate, with the forint mostly steady since easing started last month. The country faces the threat of a downgrade to one notch above junk by Fitch Ratings on Friday.

Meanwhile, on Wednesday, the Czech central bank is expected to keep borrowing costs at the highest level since 1999.

Turning south, Turkey’s central-bank decision on Thursday will be eagerly watched by investors in the first key test of newly appointed Governor Hafize Gaye Erkan.

Foreign investors mostly expect a big hike — perhaps 15 percentage points or more — to ease pressure on the lira and the current account. Without one, investors’ hopes that recently reelected President Recep Tayyip Erdogan is shifting to more orthodox economic policies will be dashed. The current base rate is 8.5%.

In Egypt, where inflation accelerated to almost 33% last month, the central bank has signaled that higher rates may not help much when it comes to slowing price rises, That means a likely hold on Thursday. The base rate stands at 18.25%, meaning it’s negative in real terms.

And in South Africa, data on Wednesday may show inflation edged closer to the ceiling of the central bank’s 3% to 6% target range.

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

Asia

In Southeast Asia, the central banks of Indonesia and the Philippines are expected to keep rates on hold on Thursday, while Singapore and Malaysia report inflation figures on Friday.

In China, banks are likely to lower their loan prime rates after the People’s Bank of China eased rates.

Bank of Japan board members Seiji Adachi and Asahi Noguchi will speak halfway through the week, while the latest Japanese inflation figures on Friday are set to show a further slowdown in core price growth despite gains in an underlying index.

South Korea and New Zealand report trade data for the latest insight into global demand, while Reserve Bank of Australia’s deputy and assistant governors will speak on Tuesday.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Latin America

Banco Central de Chile is expected to keep its key rate at a record 11.25% for one last meeting on Monday.

Looking ahead to next month, economists and traders in central bank surveys see Chilean policymakers beginning to unwind their record 1,075 basis-point hiking campaign with a half-point reduction now that inflation is clearly in retreat.

In Colombia, look for April GDP-proxy data to show some cooling from the robust first-quarter pace.

Reports on Mexican retail sales and mid-month inflation precede Banco de Mexico’s Thursday rate meeting. Banxico’s board snapped a record 725 basis-point tightening cycle in May while pledging to keep the key rate at 11.25% for an extended period amid a “complicated and uncertain” inflation outlook.

The highlight of a very light week in Brazil is the central bank’s June meeting, with policymakers locked in on holding the key rate at 13.75% for a seventh meeting.

Officials are seen cutting rates in the third quarter, though, and economists surveyed by the central bank expect a year-end rate of 12.5%. Analysts polled by Bloomberg forecast that all five of the region’s big monetary authorities will be easing before 2024.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

--With assistance from Vince Golle, Robert Jameson, Andrea Dudik, Monique Vanek, Laura Dhillon Kane, Yuko Takeo and Ott Ummelas.