Portugal’s government bond rating was raised two levels by Moody’s Investors Service, which cited the economy’s “solid” medium-term growth outlook.

The rating was revised to A3 from Baa2, with a stable outlook, the New York-based credit rating company said in a statement on Friday. Moody’s in May had raised the outlook to positive.

The upgrade “reflects the sustained positive credit effects over the medium term of a series of economic and fiscal reforms, private sector deleveraging and ongoing strengthening of the banking sector,” Moody’s said in the statement.

While the country’s economy is expected to slow this year, after bouncing back following the pandemic, the government plans to keep lowering the debt burden. Portugal had the third-highest debt ratio in the euro area in 2022 and the European Commission projected earlier this week that it will be ranked sixth in 2023, as its debt-to-gross domestic product ratio drops below the levels of France, Spain and Belgium.

Portuguese Prime Minister Antonio Costa unexpectedly resigned last week amid a probe into possible influence peddling in government. President Marcelo Rebelo de Sousa then called an early election for March 10, adding that the prime minister’s resignation will formally take effect in early December to allow lawmakers to approve the outgoing government’s 2024 budget.

Moody’s said the resignation and the corruption investigation “may slow progress in investment and reforms,” though “the evidence so far is that Portugal’s institutions allow the country to address the issue effectively.”

“The fact that this decision by Moody’s was taken after early elections were scheduled demonstrates that the economy’s fundamentals are robust and confirms that Portugal conquered a place among the group of countries with greater credit quality and greater international credibility,” Finance Minister Fernando Medina said in an emailed statement.

Budget Surplus

The 2024 budget includes income tax cuts and targets a surplus of 0.2% of gross domestic product, smaller than the surplus projected for 2023. Costa has been premier since 2015.

Read more: Who Will Lead Portugal Now? Turmoil Starts Race for Premiership

A change in government may not necessarily lead to a major shift in budget policy. With the debt ratio above 100% of gross domestic product and with a slowing economy, fiscal discipline will likely remain central to any administration.

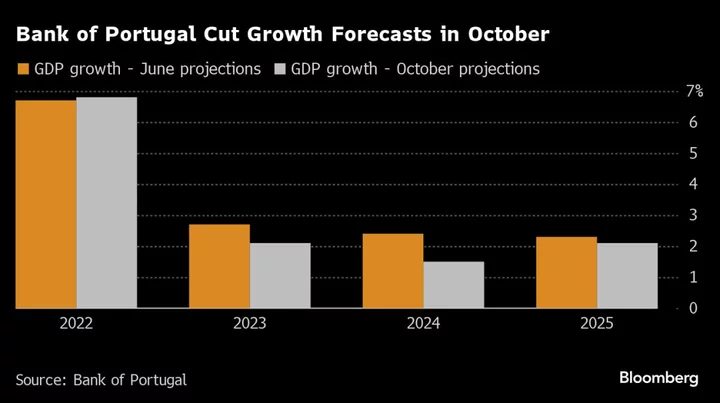

The Bank of Portugal sees growth of 2.1% this year and 1.5% in 2024, down from 6.8% in 2022. Moody’s said it expects the economy to grow about 2% a year in the next five years.

Portugal’s 10-year bond yield was at 3.25% on Friday, compared to about 3.2% six months ago . It peaked at 18% in 2012 at the height of the euro region’s debt crisis.

Portugal last had an A-range Moody’s rating in 2011. Fitch upgraded Portugal one step to A- in September, while the country has a BBB+ rating with a positive outlook at S&P Global Ratings.

“Portugal now has A-level ratings from three rating agencies (Moody’s, Fitch and DBRS), which opens the door to a very wide set of investors in Portuguese government debt,” the finance minister said.

(Adds comments from finance minister in seventh, final paragraphs.)