The Philippine central bank resumed tightening monetary policy as it lifted its benchmark interest rate by 25 basis points in an off-cycle decision.

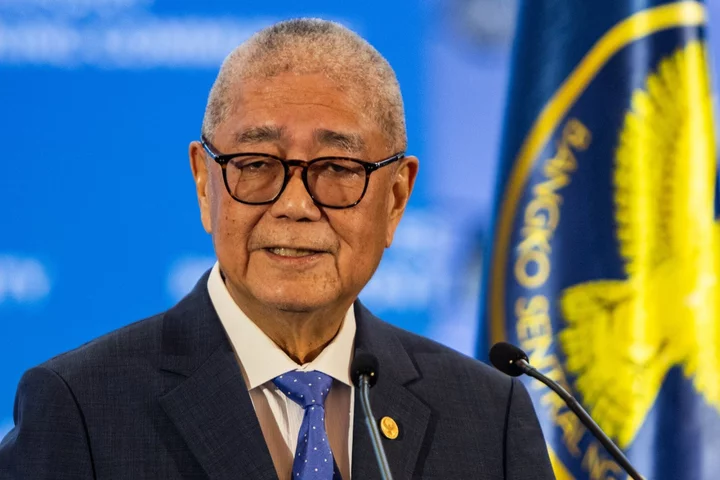

The Bangko Sentral ng Pilipinas will increase its target rate to 6.5% effective Friday, Governor Eli Remolona said in a briefing Thursday, announcing the decision made ahead of the scheduled Nov. 16 monetary policy meeting. The move will bring the BSP’s total rate increases to 450 basis points since May 2022 when it started its most aggressive tightening campaign in two decades.

The move was telegraphed by the governor earlier this week, suggesting that inflation risks have risen after global oil prices soared as the Middle East conflict intensified.

Indonesia surprised with a rate hike last week after eight months of keeping borrowing costs steady while Reserve Bank of Australia’s new governor this week said policymakers won’t hesitate to raise rates if there’s a “material upward” risk to the inflation outlook.

Overall price gains in the Philippines, which cooled from February to July, have accelerated in the past two months.

Remolona himself has doubled down on hawkish rhetoric since he took office in July, raising the possibility of an unscheduled rate increase just days after the BSP kept the policy rate unchanged for a fourth straight meeting on Sept. 21.

The minutes of that meeting released on Oct. 19 showed that authorities already saw risks of missing the central bank’s 2%-4% inflation target for a third year in 2024 amid price threats from El Nino, food supply constraints and higher power and transport costs.

The BSP’s hawkish stance, however, has drawn concerns from other government officials who warned of monetary tightening’s long-term impact on economic growth.

--With assistance from Cecilia Yap, Manolo Serapio Jr. and Andreo Calonzo.