Treasury Wine Estates Ltd. says cheaper bottles of its flagship Penfolds brand could quickly return to the Chinese market should Beijing decide to remove tariffs that have crippled Australian imports.

The company could quickly ramp up exports of bottles priced in the A$30 ($19) to A$40 range, including Penfolds Max’s, a popular brand in the Chinese market prior to duties, Chief Executive Officer Tim Ford said in an interview. Treasury reported an 11% increase in full-year adjusted earnings on Tuesday.

China’s onerous tariffs on Australian wine are in focus after Beijing scrapped duties on the nation’s barley shipments earlier this month, signaling improving relations between the two trading partners. The Chinese market accounted for about 30% of Treasury’s earnings prior to the implementation of levies.

Ford said Treasury’s cheaper wine could land in China as soon as six weeks after the end of tariffs. The more expensive bottles that start at A$100 would need to be redirected from other markets and may take longer, he added.

In May, Ford said Australia’s wine shipments to China could take years to fully recover following any easing of tariffs, adding that Treasury would maintain the export diversification it’s built since the implementation of curbs.

“We could turn the tap on that entry level luxury A$30-to-A$40 wine much more quickly,” Ford said on Tuesday. Hundreds of thousands of cases of Penfolds Max’s were sold into China prior to the tariffs, he added.

Beijing slapped steep tariffs on Australian wine in 2020, accusing the country of dumping on the Chinese market, with souring diplomatic relations impacting other commodities including coal and shipments of seafood. Australia has taken the dispute over wine to the World Trade Organization.

Shares of Treasury closed 2.8% higher in Sydney on Tuesday, the first gain in four sessions. The company reported earnings before interest and taxes of A$583.5 million, meeting analyst estimates. Net income fell 3.3%.

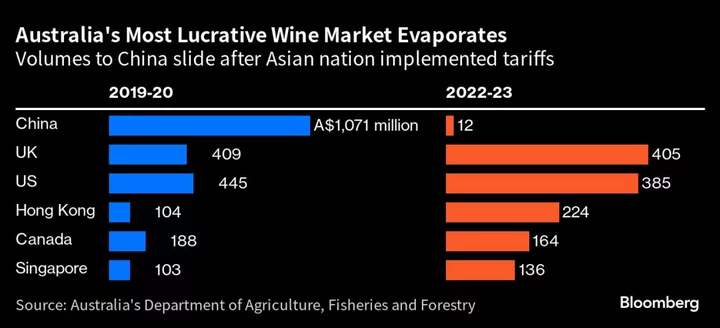

The trade with China was worth more than A$1 billion to Australia in 2018-19 and 2019-20 before the implementation of tariffs, according to the nation’s agriculture department. The value of shipments to Hong Kong has almost doubled over the past five years to A$224 million, but those to the US and UK have eased in 2022-23, figures from the government show.

Even if tariffs are lifted this year and Chinese consumption of Australian wine rebounds, it will take at least two years to work through a glut, according to Rabobank. The nation has enough wine in storage to fill 859 Olympic-sized swimming pools, or over 2.8 billion bottles of wine, the bank said.

Speaking at an Australian Industry Group dinner in Sydney on Monday, Prime Minister Anthony Albanese said he plans to bring up trade impediments that remain on wine, lobster and some beef exporters when he next meets with Chinese President Xi Jinping. The Australian leader is weighing a trip to Beijing to hold talks before the end of 2023.

Treasury said last month that it would introduce its first China-sourced premium wine to the global market in August after exploring winemaking regions across the Asian nation for years. It will be available in limited quantities at A$150 per bottle.

--With assistance from Ben Westcott and Georgina McKay.