The Mexican government’s draft budget for next year includes a capital allocation to Petroleos Mexicanos to pay maturing debts that have surpassed $11 billion, according to people with knowledge of the matter.

The inclusion of Pemex’s maturing debt in the budget is a bid to ease concerns in the market about the management of the oil company’s finances, one of the people said. The finance ministry will present the draft budget on Friday.

While the government has aided Pemex before with cash injections to pay down debt, it hasn’t traditionally allocated money in the budget for it in advance. The government of President Andres Manuel Lopez Obrador is sending an early signal to investors that the oil producer will continue to have the support of the state — even with about $11.2 billion in Pemex debt amortizations coming in 2024, according to a company presentation at the end of June.

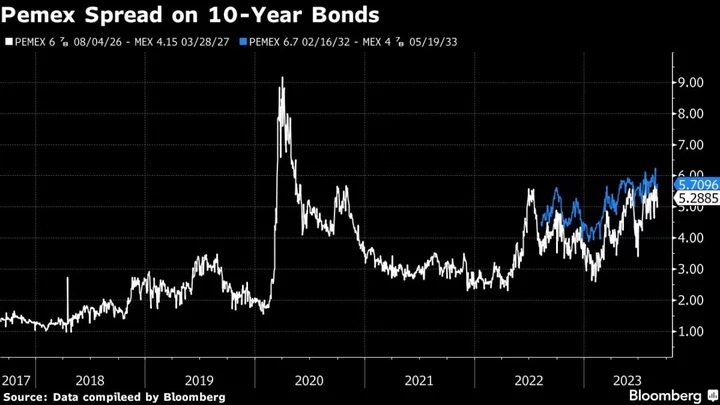

Investors’ confidence had been wavering. The spread Pemex has paid on its 10-year notes over comparable dollar debt issued by Mexico has blown out to more than 5 percentage points this year from around 1.2 percentage point prior to 2019, according to data compiled by Bloomberg.

“This isn’t going away, it’s a temporary relief measure,” said John Padilla, managing director at energy consultant IPD Latin America. The allocation for Pemex’s maturing debt signals that “they don’t want that as an overhang going into the elections. But this only creates more complications for the future administration that comes in and their ability to maintain an increasing amount of cost” for Pemex.

Representatives from Pemex and the Finance Ministry didn’t respond to requests for comment.

The 2024 capital allocation is the latest measure to bail out the heavily indebted state driller, whose finances have worsened amid a significant long-term decline in crude production and mismanagement of its refineries. In July, the Finance Ministry gave Pemex a capital injection of about $4 billion and it has deferred the company’s profit-sharing duty (DUC) payments, which has been slashed to 40% in recent years. Pemex’s debt is the highest of any major oil company, reaching $110.5 billion by the end of June.

Read More: Pemex Profits Fall Amid $4 Billion Government Injection

Including the July injection, the government has doled out about $77 billion in cash and tax cuts to Pemex in the four and a half years that Lopez Obrador has been president. The aid has been designed to alleviate the debt load while buying Pemex time to resolve deep operational problems.

A new flagship refinery was supposed to help improve profitability and reduce Mexico’s reliance on imports, but the plant only started producing fuel this month after opening in 2022 with billions of dollars in cost overruns. The company’s six other domestic refineries saw their daily processing rate fall after they were hit by fires earlier this year, leaving them operating at under 50% capacity.

A capital allocation to Pemex in the budget would “not solve the structural problems, especially the company’s sustained negative free cash flows and sizable debt payments,” analysts led by Simon Waever wrote in an Aug. 28 Morgan Stanley research note.

--With assistance from Maya Averbuch.

(Updates throughout to include additional information on past government aid, Pemex’s refineries and commentary from a Morgan Stanley research note.)