Peloton Interactive Inc. dropped the most in more than six weeks on Wednesday after Wolfe Research LLC downgraded the fitness company to a sell-equivalent rating, saying its “path to growth doesn’t seem to exist.”

Analyst Zach Morrissey expects demand for at-home fitness products to remain muted after the pandemic pulled forward interest, and he has limited confidence in the company’s new growth initiatives, including its fitness-as-a-service rental program and third-party distribution. In addition, the path to sustainable profitability and free cash flow is unclear, Morrissey said.

“The company has made material progress improving its cost structure and liquidity runway recently,” he wrote in a research note assuming coverage of Peloton from a previous analyst. “However, we are cautious on the ability of recent initiatives to reaccelerate growth in a profitable way.”

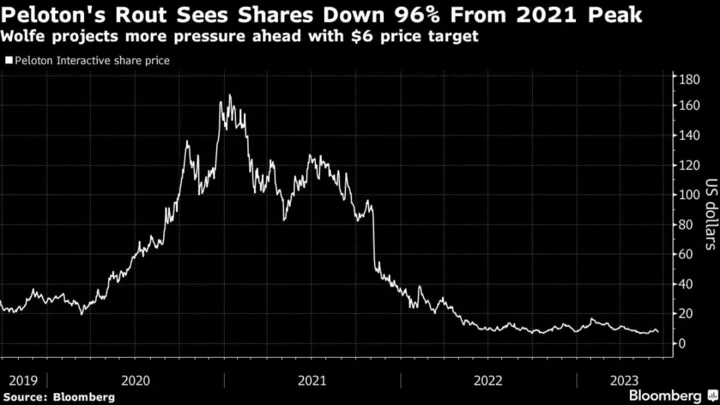

Peloton shares fell as much as 11% on Wednesday to $7.32 in the biggest intraday drop since May 4. After a strong start to the year on signs of moderating cash burn and solid demand, the stock has slumped amid a resurgence in growth concerns and an exercise-bike recall. Peloton shares are down 96% from a record high in January 2021.

Morrissey set his 12-month price target for Peloton at $6, or close to half of the $11 average among analysts tracked by Bloomberg.

--With assistance from Ryan Vlastelica.