The People’s Bank of China will likely inject ample liquidity into the money market after interest rates surged on Tuesday, according to a person close to the central bank, as state media blamed financial institutions for “disturbing” the market.

Money market rates will likely retreat toward the rates used in the central bank’s open market operations from Wednesday, said the person, who asked not to be identified. Liquidity in the banking system is relatively abundant, the person added.

The unusual statement by a person close to the bank came after liquidity in the interbank market was “very tight” on Tuesday, with annualized borrowing costs for some nonbank institutions rising as high as 20%, a bank trader said.

A report by state-owned China Central Television blamed unidentified financial institutions for disturbing the market.

“Some institutions, with the aim of maximizing profits, depend too much on rolling-over financing, borrowing short and investing long — creating their own liquidity risks, which disturbs the market and creates a tense mood,” the report said.

The report tried to downplay overall market risks. “Only a small number of nonbank institutions and asset management products are financing at high interest rates. The number and amount of transactions account for a low proportion of the entire market,” it said.

“As of 19:00, most institutions have smoothly closed trading and settlement,” it added, citing market participants close to the central bank.

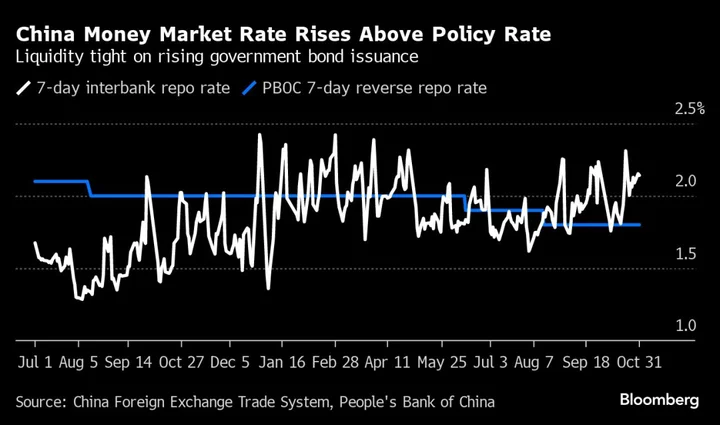

Funding costs in China’s money markets shot up in recent weeks due to factors such as a large amount of government bond issuance and tax payments. A bank trader said there was high demand for funds at month-end, and large bank offers couldn’t satisfy the demand.

The central bank has been trying to lower costs by injecting record amounts of liquidity.

Economists expect further action by the PBOC to add liquidity. Citic Securities Co., Natixis SA and Jones Lang Lasalle Inc. are among those who’ve said the PBOC may cut the reserve requirement ratio for banks by 25 basis points in the next two weeks.

Meantime, China’s latest economic data signaled continuing challenges. The country’s factory activity fell back into contraction in October, while an expansion of the services sector unexpectedly eased — suggesting that the is in need of support, according to the official manufacturing purchasing managers’ index released Tuesday.

READ: China’s Factory Activity Shrinks, Fueling Calls for More Support