China’s central bank governor stressed tolerance for slowing growth in the short term as the world’s second-largest economy transitions away from property and infrastructure toward new drivers of activity.

In an address to bankers in Hong Kong, People’s Bank of China Governor Pan Gongsheng said he was confident the economy will enjoy “healthy and sustainable growth” in 2024 and beyond, citing rising sectors like renewable energy. He also downplayed concerns over risks related to property and local government debt issues, after earlier meeting with top executives from banks including HSBC Holdings Plc. and Goldman Sachs Group Inc.

“The traditional model of relying heavily on infrastructure and real estate might generate higher growth, but it would also delay structural adjustment and undermine growth sustainability,” Pan said at the conference, organized by the Hong Kong Monetary Authority and the Bank for International Settlements.

“The ongoing economic transformation will be a long and difficult journey. But it’s a journey we must take.”

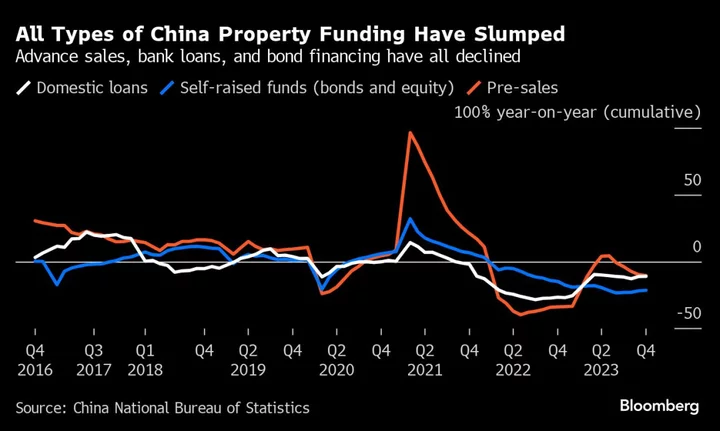

Turmoil in the property sector underpinned worries about the strength of China’s economy this year, with data going into the fourth quarter suggesting a mixed outlook. While consumption is recovering, real estate is continuing to shrink. Still, the economy is on track to hit an official growth target of around 5% for the year, meaning markets are shifting their focus to 2024. Structural challenges from housing, an aging population and low business confidence remain concerns.

In a sign of how urgent it’s become to stop the property sector’s downward spiral, authorities are considering unprecedented support for the real estate sector. That includes allowing banks to offer unsecured short-term loans to qualified developers, Bloomberg News reported earlier.

“China’s real estate sector is searching for a new equilibrium,” said Pan, adding that the property market’s adjustment is beneficial for the economy in the long run. He also reaffirmed that spillover effects from the sector to the financial system are “quite limited.”

Pan also reiterated that China’s overall government debt is relatively low compared with other economies, and stressed that debt was borrowed for infrastructure investment and backed by “tangible assets.” The debt is also unevenly distributed within the country, he pointed out, saying that economically more advanced regions in central and eastern China won’t have a problem repaying their debt.

Pan said it would be difficult for China’s annual growth to hit the 8%-10% rates seen in the past as the economy has expanded in size. He cited a range of positive signals, though, from improving retail sales to a pickup in private investment when excluding real estate. He reiterated the central bank will keep monetary policy accommodative.

Economists expect the PBOC to step up liquidity support for the economy via a cut to banks’ required reserves in the coming month, as the central government issues additional sovereign bonds to fund infrastructure spending. Any reduction of policy interest rate is seen as to be postponed to early next year, however, with depreciation pressure on the yuan only alleviating recently while banks are still faced with narrowing profit margin.

Pan told the conference on Tuesday, organized by the Hong Kong Monetary Authority and the Bank for International Settlements, that the PBOC will continue to step up cooperation with Hong Kong. Pan referred to Hong Kong as an important connector to the international markets, without referencing its status as a special administrative region.

His earlier meeting with bankers in the city was to exchange views on financial cooperation between mainland China and Hong Kong as well as the city’s status as a financial center, the PBOC said in a statement.

(Updates with additional details throughout.)