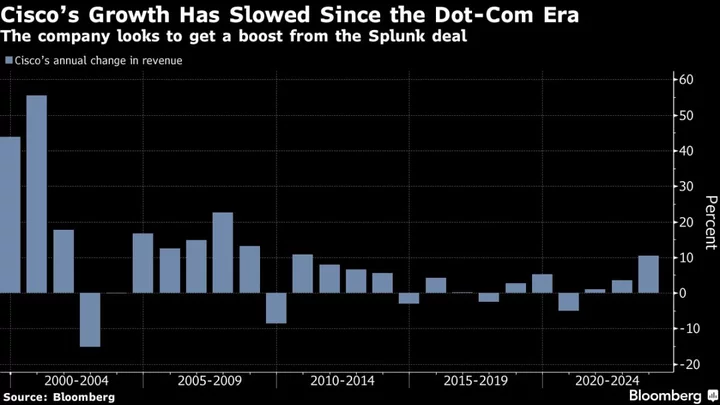

Cisco Systems Inc.’s Chuck Robbins, who has spent years working to restore the networking company to its former glory, is now looking to the $28 billion acquisition of Splunk Inc. to help speed up the effort.

Robbins, Cisco’s chief executive officer since 2015, is betting that Splunk’s data-crunching credentials can help fuel growth and attract new kinds of customers in the artificial intelligence era. But the acquisition — Cisco’s biggest ever — is unlikely to revitalize the Silicon Valley stalwart by itself, raising the question of whether more deals are on the horizon.

Cisco was once the envy of the tech world. When the internet was first being built out, the company’s networking switches and routers were a prized commodity. During the dot-com era, it briefly eclipsed Microsoft Corp. as the most valuable company — with a half-trillion-dollar market capitalization.

Read More: Splunk, a Cave Diver for Data, Lures $28 Billion Cisco Bid

Cisco is still the biggest seller of networking gear, but it’s become a less exciting business. The market is characterized by large but often infrequent purchases, and many big buyers of equipment switched to cheaper alternatives. Under Robbins, Cisco has been trying to pivot to a subscriber and services model that keeps the money flowing.

That’s where Splunk comes in. Its data services have benefited from the boom in cloud computing and AI, and provide the kind of customer relationships Cisco is looking for. That’s why Robbins offered a premium of 31% over Splunk’s share price in cash — a transaction that’s equal to about 10% of Cisco’s $216 billion market value.

Robbins pitched the deal as a chance to strengthen Cisco’s offerings in markets that are growing quickly. It also will build on initiatives that he’s already put in place through smaller deals and internal investments, he said. Splunk tools allow subscribers to better protect their networks and diagnose where — and how — something has gone wrong.

The computing and networking industry is changing far more quickly now, and Cisco can create value from the massive growth in data, Robbins told analysts Thursday. Splunk also will help speed the rollout of AI products.

Robbins, who joined Cisco in 1997, worked his way up through various positions in the San Jose, California-based company, including a stint as worldwide head of sales, before taking the CEO job.

In response to new trends in networking, he opened up Cisco’s gear so that customers can buy just the parts they want — down to individual components. He’s added more software and services, mostly provided via the cloud, mirroring a shift at Microsoft toward long-term relationships.

That’s one area where Splunk will help Cisco accelerate its efforts, said Chief Financial Officer Scott Herren. Splunk will bring in $4 billion of recurring sales, he said in an interview. That builds on the $24 billion in recurring revenue that Cisco took in last year, out of a total of $57 billion.

“That’s the benefit of having made this transformation,” Herren said. “It gives us much more predictability and much more visibility into our results. And so it’s lower risk.”

While people still think of Cisco as a seller of switches and routers, they should remember that the hardware is now sold with software and services, he said. That keeps customers in its orbit.

But Cisco may need to make further acquisitions to complete its transition, said Daniel Morgan, a fund manager at Synovus Trust. A string of earlier purchases didn’t do much to move the needle, he said. And even Splunk will only accomplish so much.

“Cisco needs to do more of these type of larger deals to boost top-line growth as their core traditional business becomes mature,” Morgan said. Splunk helps Cisco’s security business, but “the impact is muted” because that unit is still relatively small, he said.

Herren acknowledges that Cisco may have to spend money to make money. Speeding up growth is a central mission at the company, and the motivation behind the Splunk deal, he said.

“That’s one of our top priorities for our capital allocation,” he said. “And that’s really what was what motivated this.”