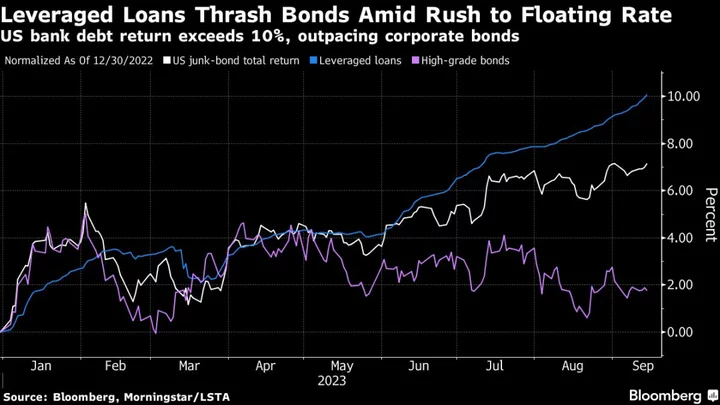

Fixed-income investors that are “risk on” are benefiting from the global economy’s ongoing resilience, fueling appetite for leveraged loans in particular.

Total returns from the assets are about 10% so far this year, according to a US leveraged loan index, and the average price of a leveraged loan in the secondary market is a bit less than 96 cents on the dollar, the highest since May 2022 after inflation exceeded expectations.

“Demand is strong,” Jeremy Burton, a portfolio manager at PineBridge Investments, said in an email. “This is driven by an improving macro outlook amongst investors, who are assigning higher probability weightings to the ‘soft landing’ scenario.”

Almost three-in-four fund managers now expect the economy to avoid recession at the very least, according to a global poll by Bank of America Corp., despite central bank efforts to slow growth and crimp inflation. Default expectations are falling as a result, Burton said, improving the credit market outlook. That’s despite the risk that higher interest rates could hurt heavily-indebted borrowers.

High benchmark rates can also make floating-rate products more popular, Burton said. Some money managers are selling longer-term bonds and buying floating-rate debt because of the protection they offer against further rises in the cost of borrowing, he said.

Debt sales launching against this backdrop are finding hungry investors. Restaurant Brands International Inc., which owns fast-food chains including Burger King and Popeyes, sold a $5.175 billion loan this week.

The size of the deal was increased twice and the issuer is paying less to borrow than initially discussed, highlighting the demand. It was both the largest loan sale since early 2022 and the largest refinancing deal this year, according to data compiled by Bloomberg.

Even lower-rated borrowers are benefiting from the rally. ProAmpac PG Borrower LLC, a maker of packaging materials rated six notches below investment grade, came to market Thursday with a $2.085 billion amend-and-extend transaction, suggesting growing confidence among lower-rated issuers.

Read More: Leveraged Loans See High-For-Longer Boost Despite Supply Surge

It’s a signal that borrowers are seizing an opportunity to tap into renewed demand, a contrast with the first half of the year when the market was all but shut to lower-rated names.

Another sign that market sentiment has shifted: more than a quarter of loans are trading above par, the highest proportion since January 2022, according to a Thursday note from JPMorgan Chase & Co. strategist Nelson Jantzen. Usually when at least 30% of loans trade above par, repricing volume begins to surge, hitting an average of $70 billion over the subsequent three months, he wrote.

Despite the turnaround, institutional loan issuance is down 25% in the US this year compared with the same period last year. And if rates remain high “companies will have to deal with another maturity wall in the not-too-distant future,” Morgan Stanley strategists including Vishwas Patkar wrote in a note on Friday.

For now, demand will probably stay strong for the rest of the year, said Frank Ossino, a portfolio manager at Newfleet Asset Management, citing the supportive economy and high loan coupons.

Week in Review

- Banks are increasingly muscling in on the $1.5 trillion private credit market in a move that further blurs the lines between private-lending funds and their traditional banking rivals.

- Sixth Street Partners-backed Legends Hospitality is in talks with private credit firms led by Ares Management Corp. and KKR & Co. to finance its potential acquisition of ASM Global.

- Apollo Global Management Inc. is open to partnering with banks on private credit deals, the buyout giant’s deputy chief investment officer John Zito said on Bloomberg Television Sept. 13.

- Investors are increasingly willing to buy longer-term bonds, locking in higher interest payments for years in a bet that the Federal Reserve is nearing the end of its interest-rate hiking cycle.

- Chinese developer Country Garden Holdings Co. left investors grasping for more information after it again delayed a deadline for voting on its request to extend a bond.

- Chinese state-linked developer Sino-Ocean Group Holding Ltd. has suspended payment on all its offshore borrowings, citing tight liquidity.

- Deutsche Bank AG is launching a new investment manager targeting private credit opportunities on behalf of institutional clients and high net worth investors.

- TwentyFour Asset Management LLP is entering the burgeoning world of private credit, with a new Europe-focused fund launch planned for later this year.

- Wall Street bankers are dangling one of the steepest discounts in recent memory to bond investors as they look to offload billions of dollars of debt that’s been stuck on their books for months.

- Europe’s rejuvenated junk debt market just had a wake-up call, with the first shelved offering in almost a year.

- Vista Equity Partners tapped a credit line backed by its private equity stakes to finance a cash injection for Finastra Group Holdings Ltd. that allowed the software company to pull off a key $5.3 billion debt refinancing.

On the Move

- Colin Atkins, who helps oversee Carlyle Group Inc.’s liquid credit business, is set to retire at the end of the year after almost two decades at the firm.

- Michael Sutton, the head of Deutsche Bank AG’s Distressed Products Group in Europe, is leaving the lender after almost 20 years.

- Clayton Perry, who led collateralized loan obligation origination at KKR & Co., is leaving the firm.

- Royal Bank of Canada has expanded its European Credit team for financials by bringing in new hires from Credit Suisse and Bank of America.

- Houlihan Lokey Inc. has brought on board Julia Perroni, formerly head of leveraged finance for France at Credit Suisse, as a managing director in its capital markets group.

- Swedish lender Svenska Handelsbanken AB has named Anette Jeansson as its new boss of the debt capital markets business in neighboring Norway.

- Fidelis Capital, a registered investment adviser catering to wealthy clients, has hired Christopher Gunster from Bank of America as head of fixed-income strategies.

--With assistance from Jill R. Shah and Dan Wilchins.