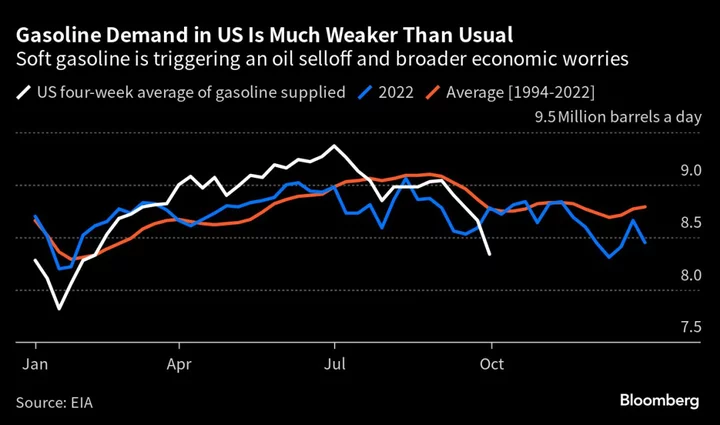

One of the oil market’s most controversial data points of recent years — a measure of how much gasoline Americans consume — is pointing to a crash in demand that’s alarming traders the world over.

On Wednesday last week, the market’s most-watched measure for consumption of the fuel in the US tumbled to the lowest for the time of year in a quarter of a century. Since the summer’s peak, it points to a decline of 1 million barrels a day. New York-traded futures, the global benchmark, plunged by 6.9%, one of several catalysts for oil’s biggest one-day rout in a year that day.

What happens in the US gasoline market has implications far beyond the fuel itself. The nation’s demand for the fuel accounts for one in every 11 barrels of oil consumed in the world, making it pivotal to the global demand picture. It can also influence inflation, helping to shape economic growth.

While observers like Goldman Sachs argue the data exaggerated demand weakness, the slump in consumption, which has been going on for weeks, nevertheless points to a downturn that’s bigger than normal for the end of US summer driving season. Part of the weakness has to do with expensive pump prices, which followed oil’s surge to record seasonal highs, a move that analysts at JPMorgan Chase & Co. say has led to demand destruction.

Any lost demand is a potential problem because refineries essentially must make the fuel even if they don’t want to. European plants are increasingly reliant on a diet of the kind of lighter crudes that are often produced in the US, which tend to spit out bigger volumes of gasoline than varieties pumped by the likes of Saudi Arabia or Russia. And since gasoline isn’t produced in isolation, refiners wishing to profit from very high diesel prices can’t avoid making gasoline too.

“Gasoline has become a surplus byproduct of refiners” in the US and Europe, who are chasing strong profits from making diesel and jet fuels, said Mark Williams, an analyst at Wood Mackenzie Ltd. who specializes in fuel markets and refining.

Annual gasoline demand growth is set to disappear in OECD Europe by this quarter “as higher pump prices erode discretionary travel and we move into the darker winter months,” he said.

US gasoline stockpiles exceeded seasonal norms for the first time in 2023, while Singapore’s hoard of the fuel and other light oil products climbed above average October levels. In Europe, a lack of export outlets helped push inventories held in independent storage at the Amsterdam-Rotterdam-Antwerp trading hub to a record for this time of the year — bar 2020, the first year of the Covid pandemic — in data going back to 2008.

The seeming decline in gasoline consumption was one of several bearish forces that came to the fore last week. Concern about the economic impact of potentially higher interest rates for the long term also led to a wider risk aversion that depressed oil.

The US data, which measure how much gasoline moved out of primary sources into the wholesale market, drew traders’ ire a year ago after wide ranging revisions and methodology changes cast doubt on their accuracy.

Over-estimated exports or under-estimated imports both have the potential to skew the numbers but they are nevertheless watched closely by gasoline and oil traders.

Declining Profits

For most of this year, oil refineries have been making huge profits from both gasoline and diesel, the industry’s two mainstay products.

For now, still-strong diesel can help refiners compensate for weaker gasoline margins, or cracks, as traders say. To maximize diesel and minimize gasoline, they can adjust cut points in the distillation process, they can divert supply from gasoline to distillates units, and try to process heavier crudes, said John Auers, managing director of refined fuels analytics at RBN Energy.

There’s a limit, however, to how much the industry can do so, and how much they can rely on diesel, which has anyway cooled off after a huge summer rally.

Profits from making diesel soared in recent months, mainly driven by supply curbs including lower yields at refineries and plant outages. Those extreme highs have since dissipated, but margins still remain well above seasonal norms in Europe, the US and Asia.

See also: Russia Lifts Diesel-Export Ban That Roiled Global Markets (2)

The outlook for refiners is deteriorating with gasoline profits collapsing and diesel margins inching lower, said Eugene Lindell, head of refined products at industry consultant FGE. Asian margins for complex refineries — specifically residue fluid catalytic cracking units — turned negative early this month, with further declines likely to crimp crude intake, he added.

But ultimately, because Saudi Arabia, Russia and other nations in the OPEC+ alliance have cut supply of diesel-rich crudes, refineries aren’t expected to drastically slash runs as they struggle to match their output to the needs of consumers.

Gasoline also faces headwinds from rising production in the Middle East, collapsing demand in Nigeria following subsidy removal, and an expected decrease in Brazil’s import requirements as more ethanol is blended into the fuel, according to Ines Goncalves, senior oil analyst at Kpler.

“Until the market starts gearing up for the US summer driving season next year, there will be little support for the European crack,” she said.

Author: Chunzi Xu, Jack Wittels and Elizabeth Low