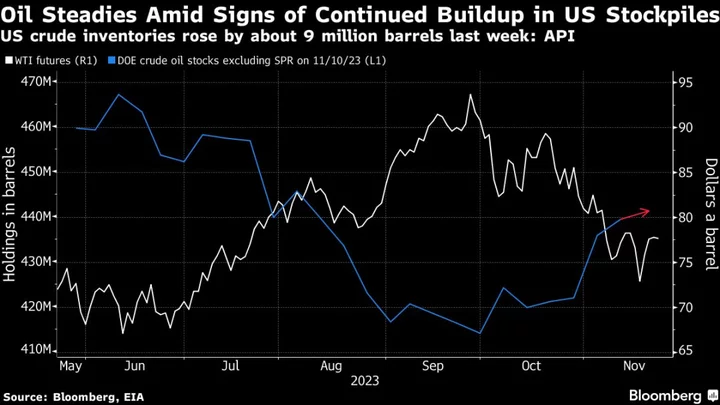

Oil steadied, with signs of another stockpile build in the US coming ahead of an OPEC+ meeting on supply over the weekend.

Global benchmark Brent held above $82 a barrel after ending modestly higher on Tuesday, while West Texas Intermediate was near $78. The American Petroleum Institute said nationwide inventories rose by 9.05 million barrels last week, with levels at Cushing also climbing, Oilprice.com reported. Separately, AlphaBBL flagged an expansion at the key Oklahoma hub.

Crude has been buffeted in recent weeks by indications that non-OPEC supplies are expanding, prompting speculation the Organization of Petroleum Exporting Countries and its allies will extend output cuts or, possibly, deepen them. Citigroup Inc. has put the odds of a further reduction at one-in-five, while for Goldman Sachs Group Inc. the chances of that were about one-in-three.

“OPEC+ will likely signal a tightening bias” at the meeting, said Vishnu Varathan, Asia head of economics and strategy at Mizuho Bank Ltd. “With US output ramping up for the fourth quarter, and Venezuelan sanctions eased, the increased supply will not sit well” with the group, he said.

An additional, collective cut by OPEC+ would raise prices by a few dollars, Goldman Sachs’ analysts including Daan Struyven said in a Nov. 21 note, while cautioning such an outcome wasn’t their base case.

Widely watched timespreads show a weakening market, with the gap between the nearest two contracts for Brent and WTI in a bearish contango pattern — when longer-dated prices command a premium to nearer ones. Brent’s prompt spread was 3 cents a barrel in contango, compared with more than $1 a barrel in the opposite, bullish backwardated structure a month ago.

In the Middle East, Israel’s cabinet and Hamas backed a deal that will free dozens of hostages from Gaza in return for a four-day pause in fighting and the release of a number of Palestinian prisoners. It’s the first lull in a conflict that began Oct. 7 and has killed thousands.

Terminal users can click here for more on the Israel-Hamas War.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.