Oil surged more than 3% after Hamas’ surprise attack on Israel over the weekend threatened to destabilize the Middle East, home to a key maritime bottleneck and several top suppliers of crude, fuel and energy to global consumers.

West Texas Intermediate traded above $85 a barrel in early Asian trade as a war-risk premium returned to markets. Traders fear an escalation of the violence — contained in the Middle East for now — could prompt a more devastating proxy war embroiling the US and Iran.

The latest events in Israel don’t immediately form a threat to supply. However, any possible retaliation against Iran amid reports the Islamic Republic was involved in the attacks would inflame fears over the Strait of Hormuz, the vital shipping artery which Tehran has previously threatened to close, as the US sends warships to the region.

“Key for markets is whether the conflict remains contained or spreads to involve other regions, particularly Saudi Arabia,” ANZ Group Holdings Ltd. analysts Brian Martin and Daniel Hynes said in a note. “Initially at least, it seems markets will assume the situation will remain limited in scope, duration, and oil-price consequences. But higher volatility can be expected.”

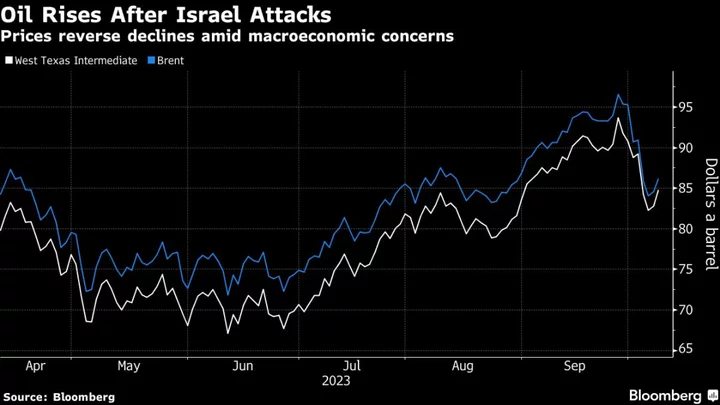

WTI and London’s Brent futures have plummeted this month, erasing more than $10 a barrel as worries about economies around the world and high interest rates clouded the demand outlook. Those fears overshadowed bullishness that led oil prices to rally in the third quarter as physical balances tightened due to prolonged Saudi-led crude output cuts.

Oil market observers will be watching for signs of a wider fallout involving Washington and Tehran after months of thawing relations. Iran has been exporting more oil in recent months, possibly contributing to moderating global prices. The Islamic state also conducted a rare prisoner swap deal, and freed up billions of dollars of frozen funds from previous oil sales.

“If Israel comes out and directly implicates Iran, we believe it will likely be difficult for the Biden administration to continue to adopt such a permissive sanctions regime,” RBC Capital Markets analyst including Helima Croft said in a note. “We anticipate that critics in Congress and elsewhere will contend that the White House is providing Iran with the financial wherewithal to sponsor such malign actors.”

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

--With assistance from Jake Lloyd-Smith and Linus Chua.