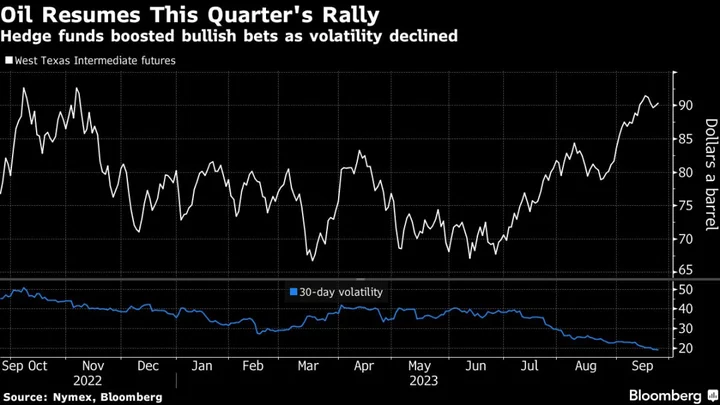

Oil climbed for a second day as hedge funds piled on bets that tightening supplies will see a resumption of the rally after a pause last week.

West Texas Intermediate futures rose as much as 0.7% to trade above $90 a barrel. Hedge funds boosted their bullish oil positions to the highest since February 2022 on the back of higher prices and easing volatility, while JPMorgan Chase & Co. added to predictions of an “oil supercycle.”

Oil has soared almost 30% since end-June, and is set for its biggest quarterly gain since March 2022, thanks to significant supply curbs from OPEC+ linchpins Saudi Arabia and Russia and brighter outlooks in the two biggest economies, the US and China. The surge has rekindled talk of the possibility of $100-a-barrel crude, while increasing price pressures in importers.

There are plenty of signs of tightness in the physical market. Russia last week announced a temporary ban on diesel and gasoline exports, lifting fuel prices. In addition, US crude stockpiles posted another decline, and oil’s timespreads are in a backwardated structure, pointing to strong competition for near-term supplies.

The policy of the Organization of Petroleum Exporting Countries and its allies has contributed to the stability of energy markets, Saudi Arabia’s Foreign Minister Faisal bin Farhan said Saturday in a speech at the United Nations.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.