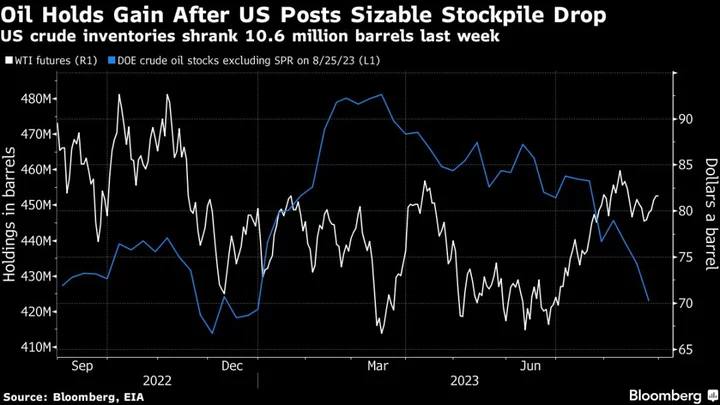

Oil held gains after a five-day advance driven by a slump in US inventories and speculation that OPEC+ leaders will prolong supply cuts.

West Texas Intermediate traded above $81 a barrel, after advancing 3.5% in the longest run of daily gains since March. Stockpiles in the US fell by 10.6 million barrels last week, cutting them to the lowest since December. Inventories at the key Cushing, Oklahoma, hub also declined to the least since January.

Saudi Arabia was expected to extend a 1 million barrel-a-day supply cut into October, according to a Bloomberg survey of 25 traders and analysts. Also, Russia said it’s discussing with OPEC+ partners the possibility of extending crude export cuts into the same month, although no decision has been made.

Crude’s latest string of advances means that futures in New York are now trading just above where they began the year. While a souring China outlook and the Federal Reserve’s campaign of monetary tightening have been headwinds, the impact has been offset by supply curbs delivered by the Organization of Petroleum Exporting Countries and its allies including Moscow.

“We see upside risks to our forecast for Brent oil futures to average $85 a barrel in the fourth quarter,” said Vivek Dhar, director of mining and energy commodities research at Commonwealth Bank of Australia. US stockpiles are expected to track below the five‑year average as the market shifts to a deficit, he said.

The market has also been markedly quieter of late, with WTI’s second-month volatility at its lowest since the end of 2019. Timespreads, meanwhile, still signal strength as the gap between the nearest two contracts for both WTI and global benchmark Brent remain in a firmly backwardated structure.

Crude held the gains despite the release of a fresh batch of data on Thursday that underlined the challenges facing China’s economy. The figures showed that manufacturing activity contracted for a fifth consecutive month in August.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.