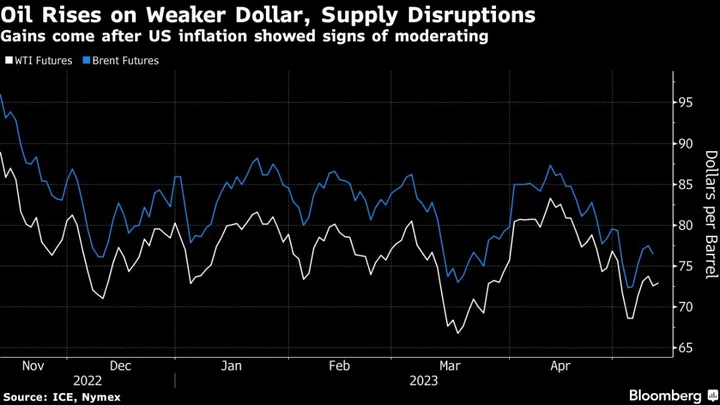

Oil rose for the fourth time in five sessions as easing US inflation weakened the dollar and traders assessed interruptions to supplies.

West Texas Intermediate advanced toward $73 a barrel, after losing 1.6% on Wednesday. US inflation showed signs of moderating in April, giving the Federal Reserve room to pause its most aggressive monetary tightening campaign in a generation. That’s hurting the US currency, aiding commodities.

Crude supplies from Canada have been hit by a spate of wildfires across Alberta. In the Middle East, meanwhile, Iraq said it’s still waiting for Turkey to restart exports via Ceyhan port as a protracted stoppage drags on.

Crude has lost 9% this year as worries over Fed tightening and a potential US recession outweighed the boost from a resurgent China after it abruptly departed from Covid Zero toward the end of 2022. Oil has also found support from a surprise output cut by the Organization of Petroleum Exporting Countries and its allies, as well as a US plan to refill its strategic crude reserves. Later Thursday, OPEC will issue its monthly supply-and-demand market outlook.

A US report on Wednesday offered a mixed picture. Nationwide commercial crude stockpiles rose nearly 3 million barrels last week, with inventories at the key Cushing, Oklahoma, hub also gaining. Still, gasoline and distillate stocks contracted, according to data from the Energy Information Administration.

Energy Daily, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.