Investors fretting that Nvidia Corp.’s massive stock buyback allocation would leave it short of funds for vital research and development should take heart from the chipmaker’s swelling free cash flow.

Nvidia is generating so much cash from the artificial intelligence boom that it has more than enough to invest in new chips and return money to shareholders. Free cash flow and spending on research and development both hit records in Nvidia’s fiscal second quarter and the company still had about $1 billion left after spending $3 billion on buybacks.

When technology companies start setting aside increasing amounts for share repurchases and dividends, some investors take it as a sign management sees fewer opportunities worth investing in and that growth is poised to slow. When Nvidia said last month it was earmarking $25 billion for stock repurchases, some expressed that worry. That sum — which Nvidia isn’t obligated to deploy — represents more than five times the profit Nvidia generated in its last fiscal year.

For others, that was missing the point. The company’s leadership in components that underpin the infrastructure being put in place for artificial intelligence systems is set to generate so much free cash that it can still afford to invest to keep its technological lead and reward shareholders.

“It was kind of like their attempt to show the market something else: We want to show how financially strong we are, we’re going to flex a bit,” said Chris Mack, an analyst and fund manager at Harding Loevner, which owns Nvidia shares as part of the $55 billion assets it has under management. “They’re generating a ton of cash and will continue to do that.”

Another concern is that Nvidia could be buying at overinflated prices after its stock tripled this year, making it the first chipmaker to boast a trillion-dollar market value. The company’s nose-bleed valuation has become a subject of debate on Wall Street with some like Research Affiliates founder Rob Arnott arguing that at 35 times trailing sales, Nvidia is “priced beyond perfection.”

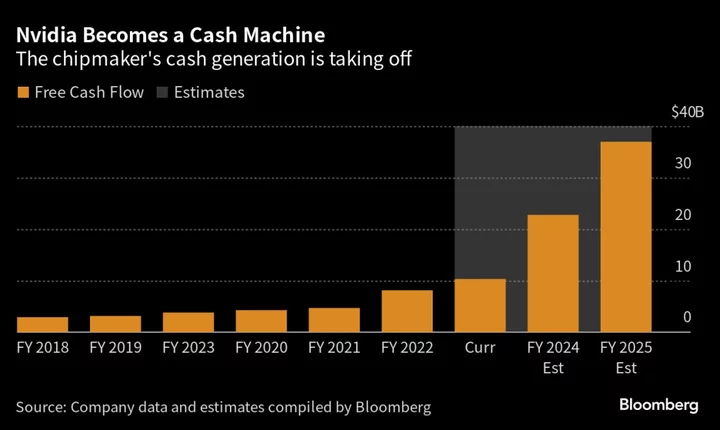

Nvidia is projected to generate about $38 billion in free cash flow in fiscal 2025, which ends on Jan. 31, 2025, according to the average of analyst estimates compiled by Bloomberg. That compares to about $23 billion in the current fiscal year.

Ultimately, it’s Nvidia’s ability to spend as much as — or more — than would-be rivals such as Advanced Micro Devices Inc. and Intel Corp. that’ll help produce products that are ahead and keep the orders rolling in.

AMD, which is racing to catch up with Nvidia in the market for artificial intelligence accelerators, spent about 25% less than Nvidia in the second quarter and had less than 5% of Nvidia’s free cash flow.

Intel, which unlike the other two, still manufactures its own chips, is spending heavily to restore its production technology to leadership and to upgrade a wider range of products to make them competitive again.

For now, Wall Street likes Nvidia’s chances of continuing to outpace a company that was until recently the world’s largest chipmaker for more than two decades.

And if that projection plays out, Nvidia will have even more funds to lavish on the silicon and software that’s given it a stranglehold on the market for AI accelerators, similar to the one Intel once had on personal computers and servers.

“It’s absolutely prudent to take a portion of that tremendous free cash flow to firm up your company’s balance sheet and then secondarily using that cash flow to invest in the company’s future,” said Phil Blancato, chief executive officer of Ladenburg Thalmann Asset Management. “At the end of the day, you can do both.”

Tech Chart of the Day

Arm Holdings Plc rallied as much as 8.5% Friday, one day after its buoyant market debut. Meanwhile, Needham & Co. initiated coverage on the chip designer’s shares with a recommendation of hold, saying the “valuation looks full.”

Top Tech Stories

- Salesforce Inc. is hiring 3,300 people across departments, marking a new investment after it eliminated 10% of its workforce in a restructuring earlier this year.

- Walt Disney Co. has held exploratory talks about selling its ABC network and TV stations to local broadcaster Nexstar Media Group Inc., according to people familiar with the discussions.

- Taiwan Semiconductor Manufacturing Co. told its major suppliers to delay deliveries of high-end chipmaking equipment because of concerns about demand from its customers, Reuters said, citing people familiar with the matter who it didn’t identify.

- Huawei Technologies Co.’s controversial Mate 60 phones use SK Hynix Inc. memory that has been available for years, TechInsights found after disassembling multiple devices.

- Netflix Inc. is ordering a second season of the new Japanese pirate series One Piece after the live-action, comic-book-based show was the top-watched TV title worldwide for two straight weeks.

Earnings Due Friday

- No major earnings expected

--With assistance from Subrat Patnaik.

(Updates stock move, chart in Tech Chart of the Day section. A previous version corrected the company name in the same section.)