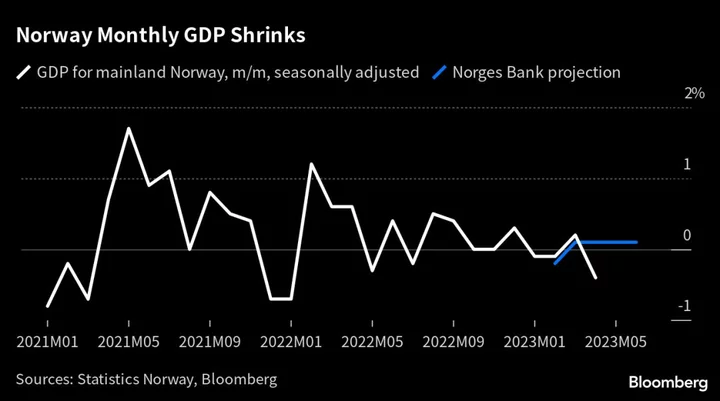

Norway’s economy trailed expectations in April by contracting the most in 15 months, painting a dimmer picture than suggested by recent data.

Mainland gross domestic product, which excludes Norway’s offshore industry, contracted 0.4% from March, the biggest decline since January 2022 and the third monthly fall in the last four months, according to data from the statistics office on Tuesday. Norges Bank and analysts surveyed by Bloomberg had expected an increase of 0.1%.

The richest Nordic economy on a per-capita basis has so far defied fears of a potential recession, with activity remaining high in past months — broadly in line with the policy makers’ expectations — due mainly to business investments and robust exports. Tuesday’s figures contrast with recent assessments by organizations including the International Monetary Fund, which said last week the fossil-fuel-rich economy remains strong after one of the highest growth rates among advanced economies last year.

“The momentum is weakening, and the details give the impression that elevated inflation and interest rates are really starting to bite,” Marius Gonsholt Hov, Svenska Handelsbanken AB’s chief economist for Norway, said in a note.

Household consumption fell 1.8% in April, with spending on goods falling by an “unusually large” 3.3%, the statistics office said. The consumption of services also declined, the office said, while pointing out there was somewhat more uncertainty about underlying growth due to the timing of Easter.

The krone, which has been strengthening versus the euro in past days, weakened somewhat following the report, trading 0.3% lower at 11.6516 per euro at 10:02 a.m. in Oslo.

The fresh data is unlikely to prevent the central bank from ratcheting up its tightening plan next week after an unexpected acceleration in core inflation to a record high in May. Even so, it may cool speculation that Norges Bank could opt for a half-point hike at its next meeting, instead of an expected 25-basis-point hike from 3.25%.

Even before the disappointing inflation figures, expectations have been growing for the central bank to extend its tightening campaign to a peak interest rate of 4% or even higher, fed over the past weeks by data including a weaker-than-expected krone, higher-than-projected wage increases and the government’s increased spending from the oil fund.

A so-called regional network report due from Norges Bank on Thursday is due to provide the last input for the policy makers regarding the state of the economy, including inflation expectations, ahead of their June 22 rate announcement.

“Taking revisions into account, growth seems to have been marginally worse than Norges Bank expected in the March Monetary Policy Report, but should in isolation not have a large impact on the rate path or the rate decision next week where we expect Norges Bank to hike by 25 basis points,” Danske Bank A/S’s economist Frank Jullum said.

--With assistance from Joel Rinneby.

(Updates with krone reaction, analyst comments from fourth paragraph.)