Norway’s government will cut spending from its $1.4 trillion sovereign wealth fund next year as it seeks to reduce price pressures in the Nordic economy.

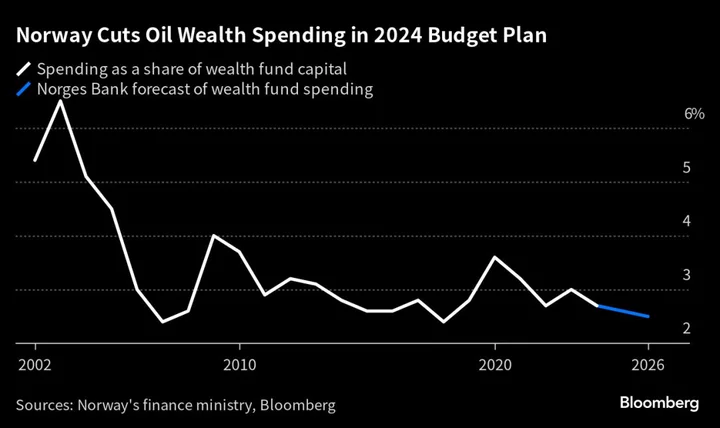

Prime Minister Jonas Gahr Store’s minority cabinet on Friday forecast the so-called structural non-oil fiscal deficit will decline to 2.7% of the fund next year compared with 3% this year, while the amount measured in kroner will rise to 409.8 billion kroner ($37 billion). The change is line with the central bank’s projection last month.

Next year’s budget is expected to be largely neutral, adding no more than 0.1 percentage point to mainland economy’s growth according to economic models, the ministry said. That’s unlikely to prevent another key rate hike by Norges Bank, which last month flagged plans for one more quarter point increase in borrowing costs to a peak rate of 4.5% before the year-end, most likely in December.

“The upshot is that this should not alter the outlook for the key policy rate path,” Svenska Handelsbanken AB’s chief economist Marius Gonsholt Hov said in a note to clients.“Having said that, the probability for another rate hike in December, as Norges Bank has signaled, is already elevated.”

The fossil fuel-rich nation has remained relatively resilient to higher prices, helped by unemployment near long-term lows and by windfall export gains that also help extra government spending. The ministry forecast the mainland economy will pick up pace next year, expanding 0.8% versus a 0.6% gain expected this year. It sees underlying inflation slowing to 4.1% in 2024 and 2.7% in 2025 from 6.4% seen this year.

“Persistently high inflation is now the key challenge facing economic policy, as it undermines the possibilities for prosperity and economic safety in people’s daily lives,” the government said. “The proposed budget is fiscally responsible and will avoid exerting upward pressure on interest rates.”

The ministry’s growth outlook still contrasts with that of Norges Bank, which last month projected economic growth slowing to 0.3% next year from 1.3% in 2023.

Norway’s government limits the amount of oil revenue it uses to cover budget deficits. Its so-called fiscal rule caps spending at 3% of the wealth fund value. Yet the fund’s fast growth over past years means that corresponding cash amounts have soared, triggering central bank warnings to reduce that cap as fund returns are dwindling.

“In 2023, higher than expected inflation led to additional spending as a compensation,” DNB Bank ASA’s senior economist Oddmund Berg said in a note, pointing out the government’s forecast for 2024 headline inflation is a percentage point below Norges Bank’s projection of 4.8%. “If Norges Bank’s estimate is correct, there is a risk that spending will be increased.” Still, he said the budget is in line with forecasts and unlikely to affect Norges Bank’s rate decision in December.

(Adds details, analyst comments from fifth paragraph.)