There is no prospect the Bank of England will loosen monetary policy anytime soon as interest rates need to be “held higher and longer than many are expecting,” policymaker Jonathan Haskel said.

In the text of a speech due to be given at the University of Warwick later Tuesday, Haskel said it was not true that “with inflation falling interest rates can be cut sooner rather than later.” He added that the UK labor market remains “historically tight.”

Haskel is one of the most hawkish members of the nine-person Monetary Policy Committee. He was in the minority who voted for a quarter-point increase this month to 5.5% when rates were held at 5.25%.

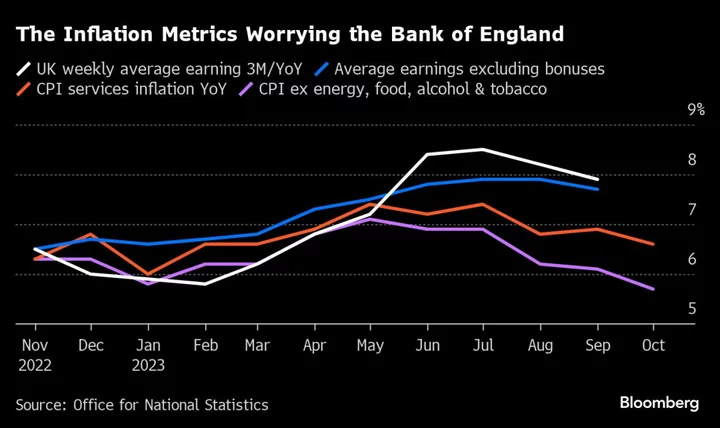

His comments echoed those by Dave Ramsden, deputy governor, to Bloomberg TV earlier Tuesday. Ramsden said UK inflation is becoming more “home-grown” and will be “challenging to squeeze out of the system.”

The BOE, which has raised interest rates on 14 occasions in less than two years, is not expected by markets to begin cutting them until August next year.

In an accompanying research paper, Haskel showed that even with “the loosest labor market in recent times” inflation will only fall to 3.2% in 2026, above the 2% target and far higher than the BOE’s central forecast for inflation to be at 1.9% at the end of 2025.

He defined “recent times” as the years following the 2008 financial crisis when unemployment peaked at 8.5%. Currently, unemployment is around half that. Haskel did not comment on the implications of his findings for interest rates or unemployment.

His paper was based on an inflation model developed by economists Ben Bernanke and Olivier Blanchard. Bernanke, a former chair of the US Federal Reserve, is conducting a review of BOE forecasting after it failed to anticipate the recent price shock. UK inflation hit 11.1% last year but has since dropped to 4.6%.

Haskel said the decline has been largely down to “energy and food price effects” and that progress “will slow markedly” from now as it is harder to remove domestically generated price pressures. There will be “a clear slowing in the decline of inflation after the initial disinflationary effects of waning energy and food price inflation wash out.”

He warned wage pressures may persist if people seek pay rises to catch up with past inflation. “Workers might bid for higher wages both if they expect higher inflation and to restore previous real wage levels,” he said.

He said the speed of labor market tightening in the UK had been unprecedented and added:

- “The responsiveness of UK inflation to energy price shocks is larger compared to other countries.”

- Food price shocks in the UK are “more persistent than other price shocks.”

- “The matching efficiency of the labor market appears to have been impaired since the pandemic, tightening the labor market.”

- “Productivity growth remains in the doldrums, putting upward pressure on costs.”

- “If ‘catch-up’ becomes more apparent, this would indicate continuing unexpected wage pressure.”

- “Finally, expectations are crucial, but are currently well-anchored. Monitoring these measures is, in my view, important in setting policy to return inflation sustainably to target.”

Haskel argued that the BOE was right in its original analysis that the a spike in energy prices led to “transitory” inflation but a subsequent sequence of shocks caused it to remain high.

“Crucially, nobody could have reasonably foreseen this historically unprecedented pattern of shocks,” he said.

(Adds comments throughout)

Author: Philip Aldrick, Tom Rees and Lucy White