More than a month after Nigeria’s central bank dropped the naira’s peg against the dollar, the country’s market for exchange-traded futures has ground to a standstill as wide fluctuations in the local currency deter traders.

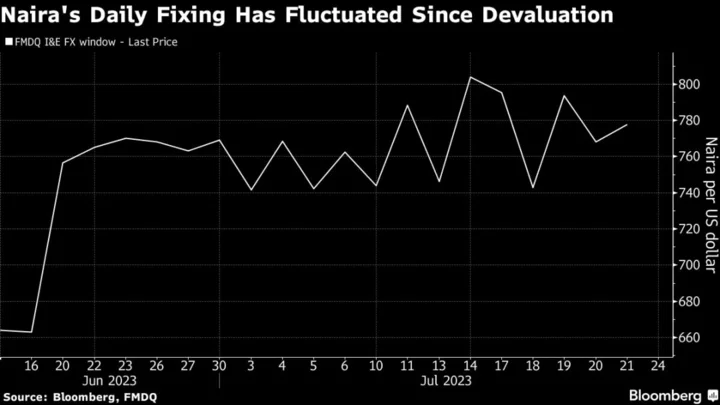

The naira has traded between 742 and 804 per dollar since June 15, the day after the Central Bank of Nigeria said it would allow the currency to trade freely in the so-called investors and exporters window, with the daily fixing on the FMDQ Exchange recognized as the official exchange rate.

To help improve liquidity, the central bank also scrapped trading limits on oversold foreign-exchange positions, and allowed hedging of short positions through over-the-counter futures. But the futures market has failed to gain “any noticeable traction” as appetite remains low, Rand Merchant Bank said in a note on July 20.

With traders unsure where the naira will finally settle, they’re not willing to take the risk of selling or buying naira futures, according to Tajudeen Ibrahim, head of research at Chapel Hill Denham in Lagos said by phone.

“There is little or no clarity around price discovery right now,” Ibrahim said. “Until there is clarity on what pricing is now, that will dampen the futures appetite. When spot is 750 today, 800 tomorrow and 850 the next day, it means the market has not discovered the price, so it affects futures contracts.”

The central bank hoped an easing of exchange controls would boost capital inflows that would help clear a backlog of dollar demand that had built up over years. That led to a an immediate devaluation of about 40% in the naira, but inflows are yet to pick up significantly as investors wait to see if the government will sustain the policy.

Foreign investors sold more stocks than they bought in June on the Lagos-based stock exchange, with outflows more than doubling from May as investors took advantage of the devaluation to exit long-held positions.

Foreign investors have adopted a stance of “wait and see how the market plays out,” said Kayode Omosebi, a banking analyst at Asset & Resource Mgmt Co Ltd in Lagos said by phone. “You will see the futures market start increasing when you start seeing inflows, particularly portfolio inflows.”

Three-month non-deliverable naira forwards were indicated at 800 per dollar on Monday, compared with a Friday’s naira close of 778.

Author: Emele Onu and Anthony Osae-Brown