BYD Co., China’s homegrown company that’s now become the world’s hottest maker of electric vehicles, has a warning for the US: New climate laws could end up backfiring and leave Americans paying more for EVs than the rest of the world.

That’s the opinion of Stella Li, who’s helping to oversee the company’s global expansion as it vies head-to-head with Tesla Inc. Li is eager to discuss growth plans for markets like Mexico, Chile and Thailand. But ask her about selling EVs in America and she gives a very simple answer: “The US market isn’t under our current consideration.”

That’s due in large part to the Inflation Reduction Act, President Joe Biden’s landmark climate bill. Part of the legislation is aimed at boosting domestic EV manufacturing through tax incentives and funding. The IRA so heavily favors American automakers and supply chains that it’s made it simply too expensive and unpalatable for BYD to operate in the US passenger-car market.

“We need to make sure with each step, we can be successful,” Li, executive vice president, said in an interview. “I strongly believe that the IRA may slow down EV adoption in the US,” she said, noting that American consumers won’t be able to access the most “affordable” options.

By design, the IRA was constructed to carve China out of America’s EV supply chain to strengthen domestic output. But the absence of BYD and rising tensions between the US and and China also are making it all but impossible for American consumers to buy some of the world’s cheapest EVs.

And for now, at least, there’s little remedy to that contradiction. Part of why BYD can sell its EVs for so much less is because of its stronghold in batteries. Apart from being an auto supplier, the company also is the world’s second-largest battery maker. China completely dominates when it comes to the supply chain for the lithium that’s needed for EV batteries, and while there are initial plans to boost US production, all of that is still far down the line.

In the end, that means US buyers will have to pay a premium to get green cars as the higher expenses for lithium batteries feed through. It’s a price difference that ultimately could set the country even further behind other parts of the world when it comes to EV adoption, blunting the climate change-fighting goals of the IRA.

It’s bigger than cars. As BYD comes to the fore globally, it helps to tighten China’s grip on products that are crucial to the energy transition as the fraught dynamics of economic statecraft ramp up political tensions. On top of EVs, China also is a key producer of solar panels, wind turbines and electrolyzers, machines that would be crucial to a hydrogen economy.

“China’s been playing a long game as it relates to the electrification,” said Bill Russo, founder and chief executive officer of Shanghai-based advisory firm Automobility Limited. “This is a geopolitical battle — it has been going on long before it ever landed into the automotive industry. The geopolitical battle for energy security is what causes nations to go to war.”

Read More: China Seeks to Control Hydrogen Energy, Eclipse Western Rivals

BYD’s rise largely is attributed to the affordability of its cars. When counting both EVs and plug-in hybrid models, BYD already is No. 1 globally.

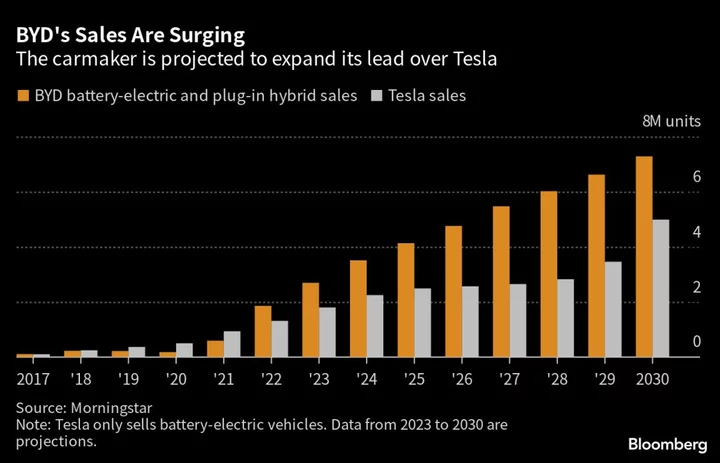

BYD’s sales, including EVs and plug-ins, are expected to reach about 2.7 million units this year — representing growth of more than 10-fold from where it was at the start of the pandemic, according to an estimate from Morningstar. Elon Musk’s Tesla will likely sell 1.8 million EVs, the firm predicts.

Now, analysts including from Morningstar and BlombergNEF say BYD is on course to eventually overtake Tesla when it comes to sales for pure EVs (not including the plug-in hybrids). Most experts see the switch happening by the second half of this decade. It’s a distinction that matters because it represents the future of the industry.

Read More: China’s BYD Is Taking On the World EV Market

As BYD grows, Li expects Latin America will be one of the company’s biggest areas of expansion.

“BYD wants to move the EV adoption rate in Latin America to 10% to 20% in the next three to five years, from less than 2% now,” Li said. Eventually, Latin America’s EV adoption rates could outstrip the US because of the IRA’s fallout, she said.

“You don’t need to go to every market — you only go to the market you feel is ready,” she said.

Li isn’t alone in pointing out the issues.

Michael Robinet, executive director, consulting, at S&P Global Mobility, said the IRA is unlikely to help EV adoption rates because it doesn’t change “the relative cost of the EV,” one of the biggest factors that leads Americans to choose gasoline-powered cars instead.

S&P Global Mobility projects the share of pure EVs hitting the road in North America will climb, with the cars representing about 18% of new-vehicle production by 2025, from 3.1% in 2020. But the firm also expects North America will keep falling further behind Greater China, where the share will surge to 36%, from 4.4% in 2020. The consultancy projects North America will also continue to trail Europe.

Lagging US adoption rates partly are a function of EVs largely being concentrated in luxury segments for American consumers, said Seth Goldstein, an equity strategist at Morningstar.

Of course, it’s in BYD’s interest to talk down the IRA given the legislation is meant to foster the company’s US competitors.

Others see the climate law’s cash injections as a pull to set up shop in the US to tap the funds. German carmaker Volkswagen AG opted in March to build a $2 billion factory in South Carolina for its new electric Scout brand, describing the incentives on offer as akin to “a gold rush.”

And BYD competitor Contemporary Amperex Technology Co. Ltd. is taking a different approach. CATL, as the world’s largest battery maker is known, has partnered with Ford Motor Co. on a $3.5 billion EV battery plant in southwest Michigan that’s stoked controversy over its novel ownership arrangement. Ford will own and operate the plant, while CATL will license its technology without taking an equity stake — a deal that’s been dubbed by Virginia Governor Glenn Youngkin as a “Trojan horse” for the Chinese Communist Party.

Lithium Batteries

The IRA stipulates EV purchases can qualify for a $7,500 tax credit, provided car models are assembled in North America and meet sourcing requirements for battery components and raw material extraction or processing.

Those are tall orders. China controls about 79% of the world’s lithium-ion battery manufacturing capacity, versus just 5.5% for the US, according to Benchmark Mineral Intelligence, an adviser to governments on critical minerals.

While the US has the fifth-largest global lithium reserves, it takes years to build a supply chain. The US also has minimal lithium processing capacity.

Meanwhile, Tesla has made dramatic price cuts to lure customers as competition among automakers heats up. In the US, the Model Y starts at $47,490, significantly lower than its $65,990 base price at the start of the year.

Even then, BYD vehicles are much more affordable, starting largely in the $15,000 to $45,000 range, Russo of Automobility said, adding that the lower price points make it “the most qualified company to be able to serve a global market for affordable EVs.”

“Right now, the bigger burning sun in the universe of electrification revolves around China. And the IRA is designed to create a binary system — a binary star,” he said. “But that other star is Jupiter by comparison to the sun. It’s much smaller. It doesn’t have the same gravitational pull.”

--With assistance from Danny Lee.