Shoppers have found it’s not a problem to buy fewer paper products and bath items. But for the companies that make these basics, it’s trouble.

Companies including Procter & Gamble Co. and Clorox Co. are responding with new items designed to solve unmet needs — and attract shoppers who are purchasing fewer facial tissues, paper towels, shampoo, shaving cream and diapers, according to the latest NIQ data.

P&G’s new Downy Rinse & Refresh laundry liquid was created to help get stubborn smells out of workout gear and baby clothes. P&G also has a new dishwasher soap that doesn’t require dish rinsing — just scrape and load, the company says. Clorox has introduced a bathroom foamer for soap scum stuck in corners, along with new Buffalo Ranch sauce sold under its Hidden Valley brand.

The so-called innovations — industry speak for new products — are a bid to help expand margins to pre-pandemic levels without having to raise prices on basics; companies can charge more for premium, new items.

While the products may be new, the strategy isn’t. Consumer businesses have a long history of trying to stand out with new items that sometimes stretch brands too far. Remember Colgate’s line of frozen meals including lasagna? Or Life Savers soda?

Getting new products to take hold is tougher than ever with competitors coming from different places such as private label and online, said Jean Ryan, vice president of strategic advisory at consultant Daymon Worldwide. “The landscape is more competitive than it’s ever been,” she said. Smaller companies and store brands are also innovating with new products, she added.

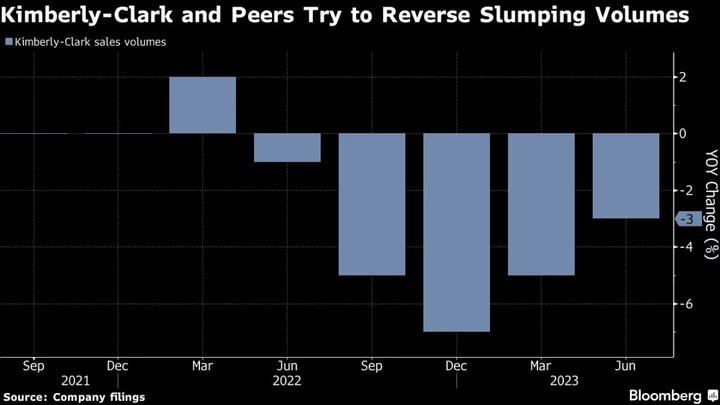

The trend’s impact can be observed in companies’ recent financial results. Kimberly-Clark Corp. and P&G reported their fifth straight quarter of volume drops for the April through June period; Colgate-Palmolive Co.’s volumes have been down for four quarters. Huggies diaper parent Kimberly-Clark said that trends are improving, yet wouldn’t predict when volumes would turn positive. “I don’t know when that’s going to be, but at some point, I want volumes to be positive,” Chief Executive Officer Michael Hsu said during a July 25 conference call.

Kimberly-Clark is introducing new products such as more breathable diapers for babies. The company is “accelerating innovation,” Hsu said.

Permanent shifts

Many shoppers are using these items less because of financial constraints, and some of these shifts have staying power, said Diana Gomes, a Bloomberg Intelligence analyst.

As consumers head back out to their normal routines, they could be adopting new habits, like using fewer garbage bags and shampooing their hair less often, Gomes said. “That could mean we have a structural shift, and that we are not going back to the same sales volumes,” Gomes said. People are realizing “maybe I don’t need to wash my hair as much.”

Or shave as much. Schick-owner Edgewell Personal Care Co. says its customers are shaving less or stretching razor cartridges to save cash. The company, which also makes Banana Boat sunscreen, reported falling volumes in its latest quarter.

For Janet Davis, 50, the shifts mean getting the most out of every tube of toothpaste and lotion container. “Now you just make every effort to knock out every last ounce,” she said.

Davis, who owns a Jamaican restaurant in Hamilton Township, New Jersey, says she doesn’t plan to go back to purchasing as much of these products as she used to pre-pandemic, choosing to save any extra cash for possible future needs or emergencies. She also sometimes skips the mouthwash when at the grocery store. “You just have to be prepared for anything; and, developing certain habits you can weather whatever next storm will come,” she said.

The consumer-behavior shifts have another benefit, said Daymon’s Ryan. “Maybe you’re spending less because you’re not entertaining as much, but there’s also the added benefit of sustainability from a less waste standpoint,” she said.

Prices Outpacing Inflation

While inflation is cooling across the US, Americans are still being charged far more for many goods and services. That includes packaged goods, whose prices were up 6.1% in June, according to NIQ.

Demonstrating the growing price sensitivity, bath and shower soap sales units dropped nearly 8% in the past 12 months through July 1 — while prices per unit are up a staggering 21%. Colgate, which also owns the Softsoap brand, saw its North American volumes tumble 7% in the second quarter after it pulled back on discounts. Much of that share went to competitors, the company said.

Davis, the restaurant owner, said she’s shopping more at Sam’s Club, searching for lower prices, and stretching what she has to last until sales begin.

“Unless you’re uber-wealthy, you sort of can’t miss the price increases,” she said. “Now you’re a little bit more diligent about getting the most out of every purchase.”