Eighteen months since the start of a near year-long selloff, the Nasdaq 100 Index has recovered half the losses that pushed it into a bear market. The question now: can the tech-heavy gauge extend its rally?

Much of the answer likely lies within its seven biggest components, which between them have accounted for most of the index’s rebound. Apple Inc., Microsoft Corp., Alphabet Inc., Amazon.com Inc., Nvidia Corp., Meta Platforms Inc., and Tesla Inc. have all gained at least 30% this year, with Nvidia and Meta both doubling. Without their contribution, the Nasdaq 100’s 24% advance this year would shrink to just 4.1%, Bloomberg-compiled data show.

According to Ari Wald, head of technical analysis at Oppenheimer, “big tech could see a pause on near-term overbought conditions, but in our view they’re just getting going. They’re coming off a very difficult period in 2022, and macro trends like a low-growth backdrop and lower yields support a recovery in these high-growth companies. We think there’s more to come.”

For sure, the actions of the Federal Reserve will have a large part to play. Expectations that the Fed may start cutting interest rates as soon as July to stoke economic growth have been a key driver of big tech’s rally and any disappointment on that front would undoubtedly weigh on sentiment.

“Further Fed rate rises would be a potential challenge for long duration assets like tech stocks,” said Russ Mould, investment director at AJ Bell. Conversely, a pause in US rate hikes, or even hints of cuts, would help, he said.

Earnings will also be key. Megacap results this reporting season were largely taken as confirmation the group can continue delivering strong growth. And given their fortress balance sheets and durable revenue streams, investors have gravitated toward the stocks in periods of uncertainty, such as this year’s banking turmoil, or the debt-ceiling standoff in Washington.

“Tech stocks feed off earnings momentum and especially upgrades to estimates,” said Mould. “The rally since last autumn has been driven by hopes that the worst is behind us in terms of earnings downgrades.”

Elevated valuations pose another question. The Nasdaq 100 trades at about 24 times estimated earnings, above its 10-year average. Both Apple and Microsoft, by far the biggest overall weights, are at premiums to the market and their own history.

From a technical perspective, the 50% retracement of the Nasdaq 100’s bear-market selloff leaves the index on the cusp of a key resistance level, which if surpassed could trigger additional buying. However, failing to break resistance can be a bearish signal, and the narrowness of the current rally suggests a risk things could reverse unless more stocks start participating.

“It’s almost like we’re stuck between a bull market and a bear market, and we don’t yet know what will win out,” said Oppenheimer’s Wald. “Market breadth isn’t as negative as it was, but it isn’t positive, and we are missing the kind of broad participation that really confirms a breakout.”

Wald nevertheless remains optimistic about the potential for further gains, and said that if the Nasdaq 100 breaks above the 50% retracement, the next area of resistance could be more than 5% above current levels.

Others agree. Given big inflows to tech stocks, “there’s a strong possibility we break through the retracement, which would be a significant milestone and could mean a significant move higher,” said Buff Dormeier, chief technical analyst at Kingsview Partners.

Tech Chart of the Day

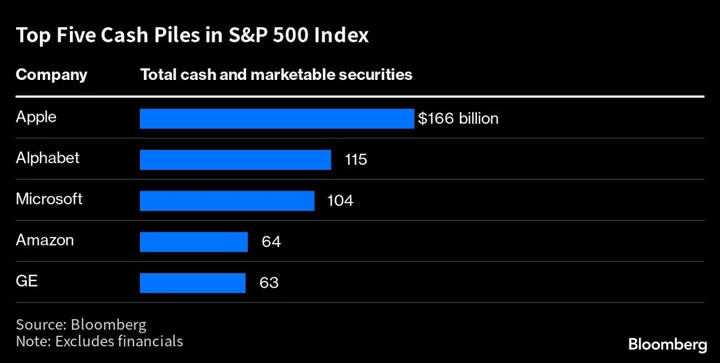

With the first-quarter results season almost done, there’s been no change in the S&P 500’s most cash-rich members, a list dominated by big tech names. Apple Inc. leads the way with more than $166 billion in total cash and marketable securities, according to data compiled by Bloomberg. Alphabet Inc. and Microsoft Corp. are the only others with cash exceeding $100 billion when the index’s financial constituents are excluded.

Top Tech Stories

- Montana Governor Greg Gianforte on Wednesday signed a law banning TikTok in the state, setting up the first legal and logistical test for broader efforts to restrict access to the wildly popular video-sharing app in the US.

- Cisco Systems Inc., the largest maker of machines that run computer networks and the internet, said orders declined 23% in the past quarter, sending shares down despite a strong sales forecast that topped analysts’ projections.

- Amazon.com Inc. plans to invest $12.7 billion in cloud infrastructure in India by 2030, joining other global tech giants in betting on growth in the South Asian nation’s digital economy.

- Insatiable demand for artificial intelligence investments has made chipmaker Nvidia Corp. the best-performing stock on the S&P 500 this year. It’s also given the fortune of Chief Executive Officer Jensen Huang a major boost.

- Take Two Interactive Software Inc., known for the Grand Theft Auto video-game franchise, soared in extended trading after beating quarterly sales estimates and hinting of a release date for a new version of its wildly popular action-adventure title.

- Micron Technology Inc. is poised to land about ¥200 billion ($1.5 billion) in financial incentives from the Japanese government to help it make next-generation memory chips in the country, according to people familiar with the matter, the latest step in Tokyo’s effort to bolster domestic semiconductor production.

--With assistance from Tom Contiliano and Blaise Robinson.