Warning bells are ringing for US stocks from signs that high fiscal spending, which underpinned economic growth this year, is unsustainable, according to Morgan Stanley’s Michael Wilson.

The strategist — one of the most bearish voices on Wall Street — said that Fitch Ratings’ downgrade of US government debt last week and the ensuing selloff in the bond market suggests that “investors should be ready for potential disappointment” on economic and earnings growth.

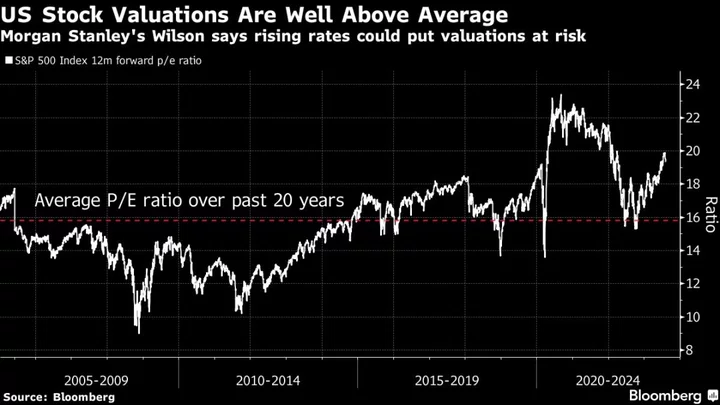

Wilson recently acknowledged that his pessimistic view for 2023 has been wrong as stock valuations soared. “Part of the reason we’ve found ourselves offside this year is that the fiscal impulse returned with a vengeance and remained quite strong in 2023 – something we didn’t factor into our forecasts,” he wrote in today’s note. The US has rarely ever seen such large deficits when the unemployment rate is so low, he added.

Fitch’s downgrade reflected the limits of loose fiscal policy, while growth has also been helped by a widening of the federal government’s budget deficit and legislation championed by President Joe Biden to increase spending on infrastructure, the green economy and semiconductor manufacturing. If spending is curtailed due to higher political or funding costs, “the unfinished earnings decline that began last year has further to fall,” putting pressure on company sales growth, Wilson wrote.

US stocks have rallied nearly 17% this year as investors focused on cooling inflation and resilient economic data rather than a drop in corporate earnings. However, the S&P 500 tumbled last week, while bond yields rose, as Fitch cut the government’s top-tier credit rating in response to heightened debt issuance to address a surge in budget deficits.

While economists have broadly pared back expectations for a US recession, strategists such as Bank of America Corp.’s Michael Hartnett have warned that the possibility of a contraction remains high as the Federal Reserve tightens credit conditions. Risks to corporate earnings are also lingering, with the strategy team at JPMorgan Chase & Co. saying deteriorating economic activity is challenging analysts’ projections that a profit recession would end in the third quarter.

--With assistance from Farah Elbahrawy.