The market for carbon offsets is approaching a “material tipping point” following months of bad news that’s spooked investors, according to an analysis by Morgan Stanley.

The voluntary carbon market (VCM) has been gripped by a steady stream of scandals, leading to wild price swings and even collapsing valuations. That has implications for firms trading such credits, which have been saddled with vast piles of stranded assets, as well as for the companies using them to underpin green claims to customers and regulators.

“Price action in the voluntary carbon markets in 2023 reflects heightened concerns about project quality and a reluctance by buyers to risk their environmental reputation on a voluntary claim such as ‘carbon neutral’,” Morgan Stanley analysts including Carolyn Campbell and Stephen Byrd said in a client note published on Wednesday.

Futures prices have fallen between 38% and 77% so far this year “amidst significant negative press of the market,” the analysts wrote. Spot market prices have fared better, on average, they said, but there’s been “a broader market softening across most major project types.” The upshot, they said, is that the market now faces “a reckoning,” but there’s reason to believe that “progress” is coming.

Read More From BNEF: BNEF Theme: The Uncharted Waters of Carbon Offsets

Read More: Voluntary Carbon Offset Tracker: July 2023

A carbon credit is a paper security representing one ton of CO2 reduced or removed from the atmosphere, generated by projects like wind farms or planting trees. Buyers can trade the units or use them to offset their own emissions, in which case they must retire the credit to avoid it being used twice.

But independent scientific analysis of a project’s CO2 reduction claims often lags behind the issuance of the corresponding carbon credits, leaving buyers in the $2 billion market exposed to losses.

Unlike its regulated equivalent in the compliance market, the voluntary carbon market lacks oversight, and buyers can find that promises made by sellers don’t always hold true.

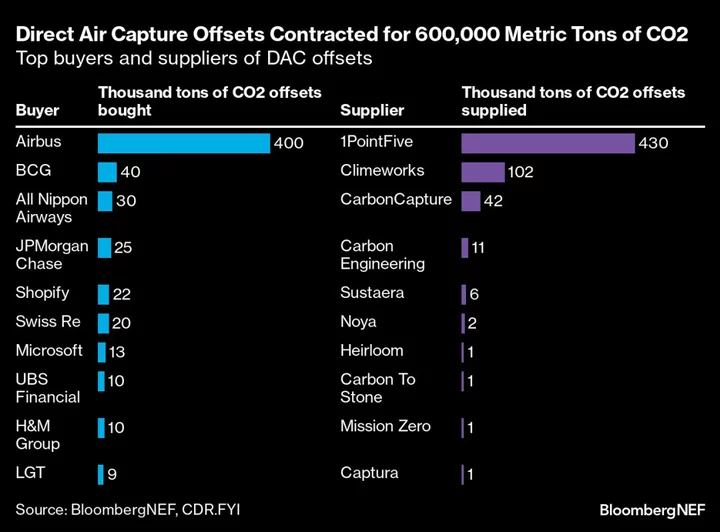

That said, there are still a number of major corporations keen to tap the offsets market as they struggle to reduce their carbon footprints, with Morgan Stanley singling out Microsoft Corp., Shopify Inc. and JPMorgan Chase & Co. in its note.

Meanwhile, efforts to improve the integrity of the market are underway. In the US, the Commodity Futures Trading Commission said in June that a new environmental fraud taskforce will examine green claims based on carbon credits in both derivatives and spot markets. The CFTC’s Whistleblower Office is already looking into a number of tips and complaints in this area, according to Steve Adamske, director of the Office of Public Affairs at the CFTC.

And new standards are being set by the Integrity Council for the Voluntary Carbon Market’s Core Carbon Principles, as well as the United Nation’s new Article 6 market.

“Efforts to improve the integrity of the Voluntary Carbon Markets come after months of negative headlines and a 90% selloff in futures,” the Morgan Stanley analysts wrote. “We think these developments are a material tipping point for the market with the reputational risk now shared, but do not expect prices to reflect these changes till 2024.”

For that reason, they expect “the market will be in a wait-and see mode between now and 2024.”

--With assistance from Natasha White.