Moody’s Investors Service has backed itself into a corner by placing Italy on the brink of being branded as junk, according to a former leading sovereign analyst.

Moritz Kraemer, who spent 17 years at S&P Global Ratings, including as its global chief rating officer for sovereign ratings, doubts that the company that used to be his biggest rival will cut below investment grade. Moody’s has scheduled a potential update on the country for Friday.

“It’s not a rosy picture for Italy right now, but it’s still not a situation in which you would think they could go to non-investment grade,” Kraemer, who is now chief economist at LBBW in the southwest German city of Stuttgart, said in an interview. “I don’t really think Moody’s will do it, because there’s really no reason.”

An announcement would be the first since Italian Prime Minister Giorgia Meloni unveiled a budget in September featuring a looser fiscal stance. That caused the spread between Italian and German bond yields, a key measure of risk, to widen to 210 basis points for the first time since January.

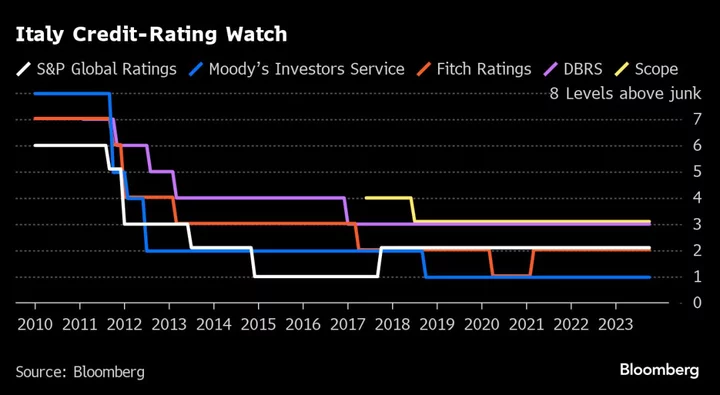

Despite that shift in profile for the public finances, both Fitch Ratings and S&P maintained stable views on the country a level higher than the Moody’s assessment of Baa3 — just one step above junk, with a negative outlook. Any lower would mean describing Italy as a “substantial credit risk.”

“I cannot explain how they ended up in this situation,” said Kraemer. “They’ve dug themselves into a hole.”

That perspective is founded on his experience as a key behind-the-scenes protagonist of Europe’s sovereign debt crisis earlier this century.

Pivotal calls Kraemer oversaw as S&P’s chief sovereign analyst in the region for more than a decade included Italy’s first downgrade since it joined the euro, in 2004. Six years later, he and his colleagues cut Greece to junk, intensifying the turmoil engulfing the country and shaking markets globally.

“We all know from experience that if you go below the investment-grade divide, things will happen,” Kraemer said. “We saw it with Greece, so there needs to be thought before action. But Greece is one thing, Italy is quite another — just looking at the size of their debt and economy.”

Compared with its two major rivals, Moody’s has the widest spectrum of assessments of members of the Group of Seven.

The US’s last remaining top credit rating is from the company, which put the country on a negative outlook last week. The Aaa assessment is now under threat because of wider budget deficits and political polarization.

Kraemer, who was at S&P in 2011 when it was first to strip the US of its top rating, observed that the comparison with Italy is significant.

“Moody’s stance is all the more surprising because they have been very lenient on other developed markets — particularly if we look at the US,” he said.

Even though a downgrade isn’t likely this week, Kraemer sees one reason why a cut to junk could make strategic sense.

“If you do really believe Italy is on the way to non-investment grade level, then as a rating agency, you would want to be the first mover,” he said. “The problems and the pressures start from the second rating agency.”

Italy Close to Junk

Moody’s placed its Baa3 rating on negative outlook in August 2022, citing accumulating risks:

(1) “Heightened risks that the political environment will impede the implementation of structural reforms, including those contained in Italy’s National Recovery and Resilience Plan.”

(2) “Increased risk that energy supply challenges will weaken economic prospects.”

(3) “Risks that Italy’s fiscal strength will be further weakened by sluggish growth, higher funding costs, and potentially weaker fiscal discipline.”

Asked for a comment on the remarks, a spokesperson for Moody’s said that the company’s published research sets out the rationale behind its approach.

Investors share Kraemer’s view that a downgrade is unlikely this week. The spread between 10-year Italian and German yields has stayed below 190 basis points in recent days and was at 183 points in early trading on Tuesday.

Kraemer acknowledges that Italy has no room for complacency, and Meloni’s government shouldn’t keep testing markets.

He sees the UK experience of turmoil last year under former Prime Minister Liz Truss as informative, not least since a big portion of Italy’s debt is held by its citizens.

“That should act as a strong disincentive to play with fire, and I still have some confidence that this political incentive will hold,” Kraemer said. “In that sense, Liz Truss was a cautionary tale.”

More generally, he says Italy’s challenges are huge, ranging from poor growth and demographics, high borrowing costs, and large pension liabilities and health-care burdens.

Debt as a percentage of gross domestic product is now seen by the International Monetary Fund as staying above 140%, even five years from now. Without a productivity revolution, its deficits will need to shrink, Kraemer said.

“It doesn’t take a math wizard to figure out where the debt ratio is going to go,” he said. “I don’t think the house is on fire in Italy, but if we extrapolate current trends, it’s going to end in tears.”

--With assistance from Alice Gledhill.

(Updates with bond spread in 17th paragraph)