The US money-market industry, one of the big winners on Wall Street as the Federal Reserve hiked interest rates, is getting another lift with more tools at its disposal to attract investors and expand its unprecedented mountain of cash.

That’s the backdrop for Wednesday’s kickoff of Crane’s Money Fund Symposium, the marquee annual event for a business that has seen assets grow by some $1 trillion in the past year to a record of almost $5.5 trillion. The roughly 450 participants will gather as a crucial debate rages in markets over whether it’s time to abandon these ultra-safe funds in favor of stocks or long-maturity bonds.

The Fed’s aggressive tightening has been a boon for money markets, which have drawn investors seeking a haven from volatility and tiring of the skimpy rates on bank accounts. The industry can point to a major change from a year ago that it expects will help it retain that appeal and keep cash rolling in.

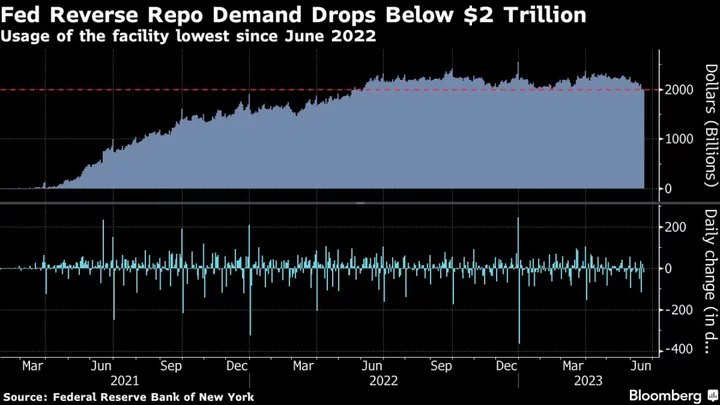

The key is that money funds now have a range of higher-yielding assets to shift into — led by Treasury bills after the resolution of June’s debt-ceiling impasse. But they also have much more clarity around the Fed’s path, so they have less need to hide out in overnight markets, where they still have almost $2 trillion stashed. That means they can buy longer maturities and eke out higher returns.

“The money-fund industry has to be feeling quite good at the moment,” said Mark Cabana, head of US rates strategy at Bank of America Corp. “Assets are up a lot, supply is increasing rapidly and money funds now have a greater ability to express clearer views on the market.”

Bill Flood

For starters, Treasury is issuing a flood of bills to rebuild its cash balance — potentially selling over $1 trillion by the end of September.

And while concerns around the banking sector have abated, lenders’ demand for dollars persists, leading Federal Home Loan Banks to issue short-term debt for that financing, which money funds scoop up. The funds are also turning increasingly to a type of repurchase agreements that offer higher yields because they carry counterparty risk.

To illustrate the advantage of these other instruments, the funds can earn roughly 5.18% on eight-week T-bills, compared with 5.05% on the Fed’s overnight reverse repurchase agreement facility. With trillions of dollars at stake, every basis point matters to investors assessing competing products, such as stocks, which have surged amid signs the economy is holding up in the face of Fed tightening.

Money-fund managers can point to an average yield just below 5%, versus sub-1% a bit over a year ago, Crane data show. But the S&P 500 Index is up double-digits this year.

“If re-risking sentiment continues, that will be another headwind to money funds,” Cabana said.

Hot Market

For industry participants assembling in Atlanta this week, the vibe couldn’t be more different than a year ago. Back then, the specter of regulatory change was a chief worry, but that threat has yet to materialize. It’s also a lucrative time for the business: Revenue for May was a record $15.4 billion on an annualized basis, according to Crane data.

Read More: Money Markets Rake In Cash as Funds Gird for Regulatory Changes

Now that the Fed looks like its nearing the end of its hiking cycle, money funds are already pulling more cash from overnight assets, extending the weighted average maturity of their holdings.

The amount of money parked at the Fed’s overnight reverse repurchase agreement facility has dropped below $2 trillion for the first time in more than a year.

Federated Hermes Inc., for example, is now targeting a weighted average maturity of 25 to 35 days for its products, up from 15 to 25 days last month, according to Deborah Cunningham, chief investment officer for global liquidity markets at the firm, which oversaw $701 billion as of the end of March.

Cunningham said retail investors exiting bank deposits have been the driver of the market’s growth, and she sees room for assets to increase further.

She expects more demand from institutional investors like corporate treasurers later this year as the Fed’s trajectory grows murky again. At that point, she anticipates money funds will prove their worth by doing everything they can to capture higher yields for as long as possible.

“There’s a whole lot more cash on the sidelines from institutional players that will be coming in during the second half of 2023, even in 2024 when rates start to go down,” she said. “We’re going to attract institutional players into that sector.”

(Updates bill rate.)