Micron Technology Inc.’s stock dropped more than 6% after China’s cyberspace regulator said that its products failed to pass a cybersecurity review in the country.

Beijing warned operators of key infrastructure against buying the company’s goods, saying it found “relatively serious” cybersecurity risks in Micron products sold in the country. The components caused “significant security risks to our critical information infrastructure supply chain,” which would affect national security, according to the statement from the Cyberspace Administration of China, or CAC.

Micron’s shares dropped as much as 6.8% in premarket trading, which would be the biggest intraday fall since November if it holds during regular trading. The stock had gained 36% this year, closing at $68.17 on Friday.

The CAC had said about six weeks ago that it was launching a security review of imports from Micron, the US’s last major memory chipmaker.

The tech sector has become a key battlefield over national security between the two largest economies, with Washington having already blacklisted Chinese tech firms, cut off the flow of sophisticated processors and banned its citizens from providing certain help to the Chinese chip industry. In a statement, the US Commerce Department said Beijing’s conclusion had “no basis in fact” and Washington will continue to try and limit industry disruptions with its allies.

“No one should understand this decision by CAC as anything but retaliation for the US’s export controls on semiconductors,” said Holden Triplett, founder of Trenchcoat Advisors and a former FBI counterintelligence official in Beijing. “No foreign business operating in China should be deceived by this subterfuge. These are political actions pure and simple, and any business could be the next one to be made an example of.”

Read More: China’s Micron Probe Is Latest Offensive in Chip War With US

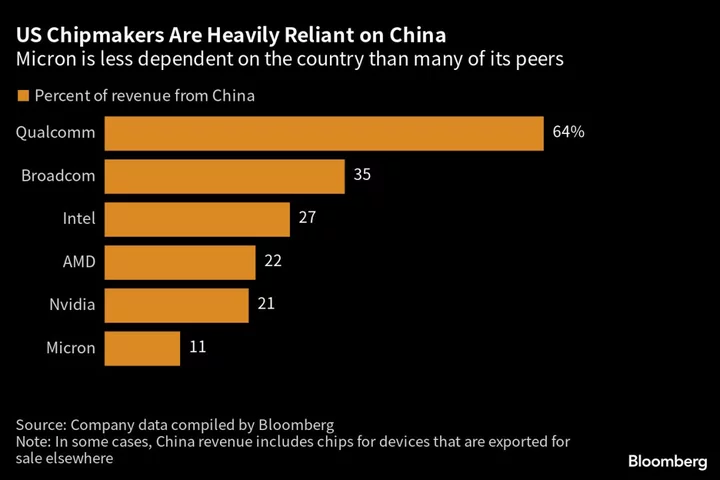

The move brings fresh uncertainty to the other US chipmakers that sell to China, the world’s biggest market for semiconductors. Companies like Qualcomm Inc., Broadcom Inc. and Intel Corp. deliver billions of chips to the country, which puts the components inside electronic products that are shipped all over the world.

US President Joe Biden voiced optimism about the China relationship on Sunday at the end of the Group of Seven summit in Japan. He said he expected ties between the two countries will start to “thaw very shortly.”

The Chinese cyber agency said in its statement Sunday that, while the country welcomes products and services provided by companies of all countries as long as they comply with its laws and regulations, the investigation into Micron products are a “necessary measure” to safeguard national security. It didn’t detail what the security risks were or identify specific Micron products that are now barred.

Micron, which has previously said it stood by the security of its products and commitments to customers, said in a statement Sunday it’s evaluating the conclusion of the review. The company is assessing its next steps, adding that it looks forward “to continuing to engage in discussions with Chinese authorities.”

Analysts at Jefferies including Edison Lee said in a research report that the CAC’s decision will likely have a small impact on Micron because it focuses on “critical information infrastructure,” meaning operations like data centers and cloud computing services with security risks. Most of Micron’s memory chips sold in China are actually used in consumer electronics, like smartphones and notebooks, they said.

“We believe this ban is narrowly focused as it applies to only CII operators,” they wrote. “Therefore, the ultimate impact on Micron will be quite limited.”

Why Making Computer Chips Has Become a New Arms Race: QuickTake

Micron derived nearly 11% of its revenue from mainland China in its last fiscal year.