Mexico’s economy grew more than expected in the second quarter as private consumption remains robust and the country benefits from strong exports to the US, its largest trading partner.

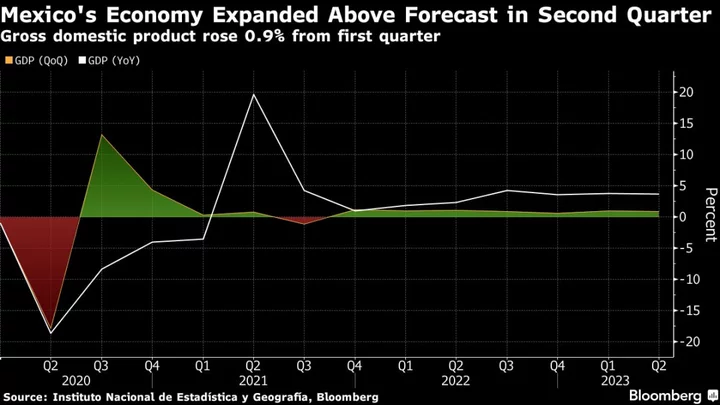

Gross domestic product rose 0.9% from the previous three months, above the 0.8% median estimate of analysts surveyed by Bloomberg. From the same period a year ago, GDP grew 3.7%, more than economists’ 3.3% forecast, according to preliminary data released by Mexico’s national statistics institute Monday.

“The services sector is what is driving growth,” said Janneth Quiroz Zamora, director of economic research at Grupo Financiero Monex. “We see that it is the motor in the most recent quarter, though in the agriculture and industrial sectors there were also important rates of growth.”

Latin America’s second-largest economy has been boosted from an inflow of investments from companies expanding operations in the country, in a process known as nearshoring. Exports have hit record highs in the last few months, and in June, the country posted an unexpected trade surplus as the value of oil imports fell while the flow of goods sold to the US remained robust.

Read more: Bloomberg Economics Primers: Mexico’s Trade Trends

Mexico “has shown notable strength despite the global economy already showing signs of a slowdown,” Deputy Finance Minister Gabriel Yorio said at a press conference last Thursday, adding that he sees growth of 3% this year.

Mexican Peso

Inflationary pressures have been gradually cooling, driven by double-digit interest rates and the strong rally of the “super peso.” While consumer price increases have eased, they’re still above the target of 3%, plus or minus a percentage point.

What Bloomberg Economics Says

The economy has been aided by increasing employment, rising salaries, high remittances and positive consumer confidence. Investment is benefiting as Mexico attracts more capital inflows. Tailwinds from strong US growth and waning supply-chain problems have also buoyed activity. The data supports the strong peso. They imply there’s less economic slack than the central bank estimated and limit room to cut interest rates.

— Felipe Hernandez, Latin America economist

— Click here for full report

The peso remains the second-best performing currency in emerging markets year-to-date with accumulated gains of almost 17%. The currency recently touched its strongest level since 2015, supported by high interest rates, nearshoring and remittances.

Over the past 12 months, the cumulative flow of remittances totaled $60.8 billion, the highest on record, and they are on track to reach approximately 4% of Mexico’s gross domestic product this year.

“The MXN rebound and increase public and private investment — supported by the nearshoring wave, among other factors — have also helped,” said Andres Abadia, chief Latin America economist at Pantheon Macroeconomics. “These drivers fully offset the hit from elevated borrowing costs and the US manufacturing slowdown.”

Estimates

All told, Banxico, as the central bank is known, still hasn’t declared victory over inflation, pledging to keep rates at restrictive levels until consumer price pressures decline in a “sustained manner.”

Mexico’s key interest rate has been kept unchanged at 11.25% for the last two meetings, with policymakers opting not to discuss a timeline on when they might begin cutting borrowing costs.

Analysts in the most recent Citibanamex survey of economists projected 2023 GDP growth of 2.4%, up from 1.9% in early May. In 2024, the economy is expected to expand by 1.5%.

(Updates with economist quote in seventh paragraph)