Meituan’s revenue jumped a faster-than-anticipated 27% after a gradually stabilizing Chinese economy drove meal delivery and travel nationwide.

Sales rose to 58.6 billion yuan ($8.3 billion) in the quarter ended March, against an average projection for 57.5 billion yuan. It reported net income of 3.36 billion yuan, compared with estimates of a 210.4 million yuan loss.

Like many of its internet peers, Meituan benefited from heightened consumer spending on meals, travel and tickets after China’s post-Covid reopening. But the bounce-back remains uneven, with pockets of the economy falling short of initial expectations for resurgent growth. Official data last week showed retail sales grew at a much slower pace than expected in April.

That patchy rebound is complicated by new entrants on Meituan’s turf such as ByteDance Ltd. ByteDance’s Douyin — TikTok’s cousin in China — is testing a grocery and food delivery service in Beijing, Shanghai and Chengdu and is looking to gain ground against both Meituan and No. 2 Ele.me, owned by Alibaba Group Holding Ltd.

Read more: Meituan Debuts in Hong Kong Monday in First Overseas Step

Meituan is fending off rivals in part by hiring aggressively to keep its lead in the $145 billion Chinese food arena. And this month, the company launch a sister app in Hong Kong on Monday, taking the world’s largest food delivery service beyond mainland China for the first time. In doing so, it will seek to challenge the likes of Deliveroo Plc and Delivery Hero SE’s Foodpanda. It will rely on a familiar subsidy-heavy strategy to draw in users and delivery people alike, distributing 1 billion HKD user incentives in the city with each newly registered user getting a coupon package valued at HK$300.

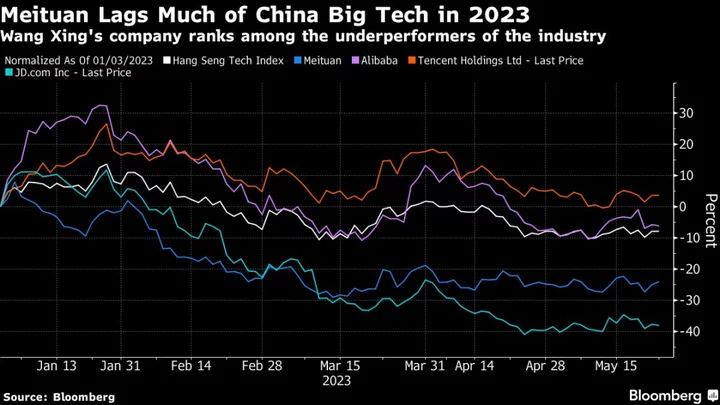

The company’s longer-term prospects hinge on its ability to navigate demand swings in a post-pandemic market and its success in new arenas and overseas, as longstanding backer Tencent Holdings Ltd. unwinds its shareholding.