Earnings season is halfway through, and one thing is becoming clear – equity investors are frustrated with all the losing.

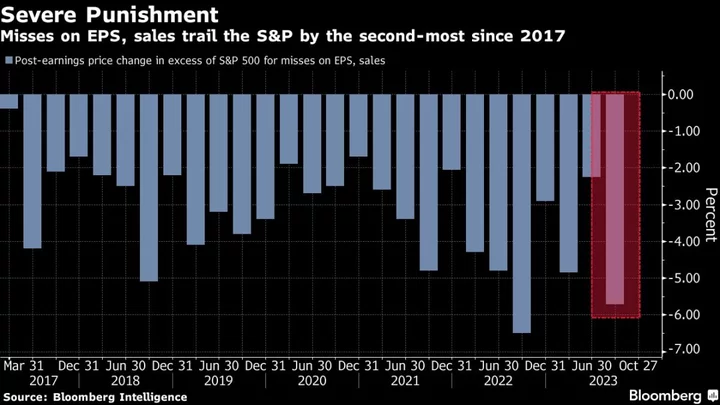

Eleven trading days have elapsed since JPMorgan Chase & Co. kicked off quarterly results, and the S&P 500 Index has declined in nine, with four of those sessions clocking drops in excess of 1%. Shares of the firms that missed on the top and bottom lines have trailed the S&P 500 by an average of 5.7% on the first day post earnings, the worst showing in a year and the second-worst in Bloomberg Intelligence’s data going back to 2017.

Uncertainty about the conflict in the Middle East, the Federal Reserve’s interest-rate path and 10-year Treasury yields knocking on 5% are behind such swings. For companies missing on quarterly expectations on top of those macroeconomic forces, a knee-jerk response is pretty much a given.

“Macro continues to dominate the market, and the reaction to earnings misses is more negative than what normally happens,” said Rich Ross, managing director and head of technical analysis at Evercore ISI. “On a broader scheme of things, it reflects the uncertainty not only about the hear-and-now, but also the visibility for next year.”

The lackluster reception highlights the ongoing pressure companies face to clear a bar that gets higher as rising costs weigh on profit margins and an unpredictable economic trajectory for 2024 lingers.

It’s not that the results have been that atrocious — in fact, profit came in above expectations for 79% of the more than 200 companies that have reported so far, above a long-term average. But the big tech firms that many hoped would sooth sentiment provided little of a tonic, and quarterly scorecards from the rest of the pack were good but not great.

The Nasdaq 100 Index is down 2.6% this week after Alphabet Inc. posted disappointing cloud results, outweighing Microsoft Corp.’s strong sales. Meta Platforms Inc. doused hopes for a long-term advertising recovery, after Tesla Inc.’s results fell below consensus estimates for profit, sales and margins. Amazon.com Inc.’s robust results helped to send the 100-member gauge higher on Friday.

Stocks in the S&P 500 Information Technology Index (which doesn’t carry Meta Platforms and Alphabet) have on average dropped 1.9% after the results, the second-worst earnings reaction behind health care, data compiled by Bloomberg show.

Meanwhile, a 10% drop in the S&P 500 from its July high has pushed the index’s 14-day relative strength index to 29, below a 30 level that to some technical analysts signal the stock has become oversold.

“While it remains to be seen if equities will start responding favorably to the earnings season, it should be recognized that the yield-driven selloff has produced oversold conditions and excessive pessimism,” said Tim Hayes, chief investment strategist at Ned Davis Research. “Seasonal and cyclical influences are turning positive with market oversold and pessimism excessive.”

Next week will be crucial as the season chugs along, with construction and mining-equipment maker Caterpillar Inc. and chipmaker Advanced Micro Devices Inc. set to disclose their results.

--With assistance from Natalia Kniazhevich.