The Bank of Japan is likely to refrain from raising interest rates in the coming year as the global economy falters and the US slips into a recession, according to Manulife Investment Management.

It would be strange to hike in the middle of a global slowdown with other central banks cutting rates, Nathan Thooft, global chief investment officer for the multi-asset solutions team and senior portfolio manager, said in an interview in New York. While the BOJ will tighten policy within the next three years, any move is unlikely within the next 12 months, he said.

The fate of the BOJ’s negative-rate policy has come under increased scrutiny recently as Japan’s inflation has persistently stayed above the central bank’s 2% goal, and the rate gap with other major economies has contributed to the yen weakening more than 10% this year against the dollar.

Thooft’s comment echoes Governor Kazuo Ueda’s view that the BOJ doesn’t have broad enough evidence yet that price growth will attain its goal.

“It’s quite likely that markets will unwind bets on a tweak” to the BOJ’s negative-rate policy, said Arata Oto, a Japan market economist at Credit Agricole Securities Asia in Tokyo. “Structural deflationary pressures still remain in place,” he said.

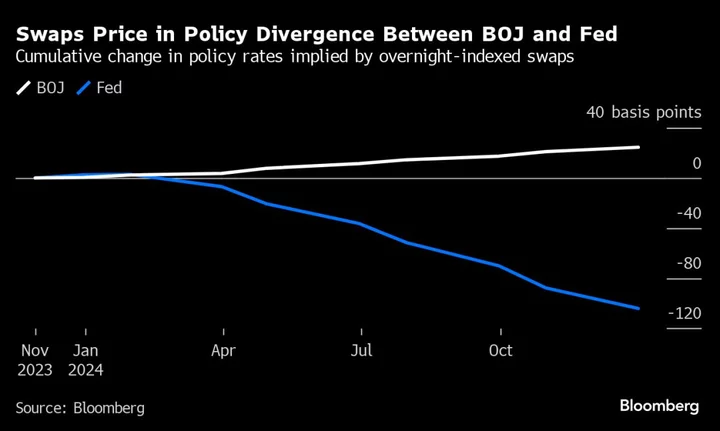

Overnight-indexed swaps have priced in an end to the BOJ’s policy of sub-zero rates by June, as well as further increases in short-term interest rates for the rest of 2024. In contrast, swaps reflect cuts of about 100 basis points by the central banks both in the US and euro zone.

In a survey in October, 70% of economists said they expect the BOJ to move toward tighter policy by April.

Read: BOJ Board Member Signals Low Chance of Policy Shift in December

Any pullback in bets on the BOJ tightening policy may drag down two-year Japanese government bond yields to zero or below, Oto said. The yield on two-year notes stood at 0.05% on Wednesday.

--With assistance from Yumi Teso, Zijia Song, Saburo Funabiki, Daisuke Sakai and Masahiro Hidaka.