Deutsche Lufthansa AG is about to embark on a tough journey to pull off a quick turnaround of Alitalia’s successor ITA Airways and overcome two decades of constant losses.

Lufthansa on Thursday agreed to buy a minority stake in ITA, and its executives think they can succeed where other managers failed: wringing a profit from the airline that long flew the flag of Italy, Europe’s third-largest aviation market.

Speaking to reporters on Friday, Lufthansa CEO Carsten Spohr said ITA could be made profitable within two years. The German airline group plans to use its global marketing muscle, loyalty schemes and network of connecting flights to boost ITA’s revenue.

“ITA is not the old Alitalia,” Spohr said. “We will make this operation a success.”

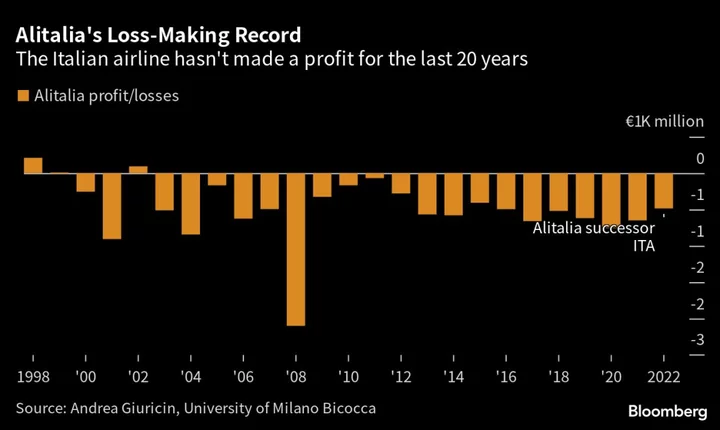

Alitalia’s track record has historically been disastrous. The company hasn’t posted an annual profit in 20 years, it’s gone bankrupt twice since 2008, and turned into a huge burden for Etihad Airways after the deep-pocketed carrier from Abu Dhabi bought a stake but failed to turn the business around. The brand officially ceased operations in late 2021, when it was reborn as ITA Airways.

Alitalia’s losses totaled about €12.4 billion since the early 2000s, when competition in the European aviation market started to increase, according to calculations by aviation expert Andrea Giuricin of the University of Milano Bicocca.

ITA Airways losses are included in calculations. The new carrier lost €486 million in 2022, according to a statement.

For Lufthansa, the foray represents a gamble on an Italian market that’s more competitive than the German carrier is accustomed to, following the rapid expansion of low-cost operators. During the annual general meeting in May, Lufthansa investors signaled unease about the planned takeover, warning management that the Italian government might wish to interfere with the running of the company.

To hedge its risk, Lufthansa plans to buy ITA in several steps, and Italy’s government will contribute a dowry of about €250 million.

ITA will add to a group of national carriers already under the Lufthansa umbrella, including Swiss and Austrian Airlines.

Lufthansa’s Spohr, a trained pilot who has run the company for close to a decade, has built the airline into Europe’s biggest aviation group, competing with the other two major conglomerates — British Airways parent IAG SA and Air France-KLM — as well as a trio of budget specialists: Ryanair Holdings Plc, EasyJet Plc and Wizz Air Holdings Plc.