The world’s 13-year experience with negative-yielding bonds is drawing to a close.

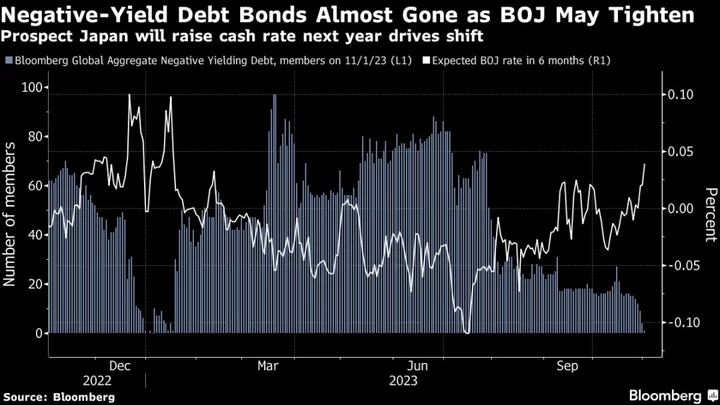

The Bank of Japan’s gradual moves to tighten policy mean the pool of bonds with sub-zero yields has virtually vanished, after amounting to more than 4,000 in 2020. Only one security — a Japanese government note due in December 2024 — briefly traded at 0% on Thursday, versus minus 0.001% on Wednesday.

This has happened before: on Jan. 4 this year, every member of the benchmark Bloomberg Global Aggregate bond index was yielding 0% or more for the first time in 13 years. While that episode lasted for only a day, the current shift may be more lasting given growing bets the BOJ will raise its benchmark rate from minus 0.1% in the first quarter of next year.

Bloomberg’s index of negative-yielding bonds peaked at $18.4 trillion on Dec. 11, 2020. At that stage it contained more than 4,600 securities, including European, UK, Swiss and Scandinavian debt. But yields have soared across the globe since then, with every developed-nation central bank outside Japan raising its benchmark rate by at least 2.5 percentage points since 2021.

“The removal of 1% as a hard ceiling for 10-year yields logically brings forward the debate around the BOJ ending negative rates sooner, not later,” said Prashant Newnaha, a rates strategist at TD Securities in Singapore.

The BOJ has faced increasing pressure to end its ultra-easy settings that helped drive the yen to the weakest since 1990 last year. The central bank owns almost 55% of the country’s government bonds and on Tuesday signaled it may allow 10-year yields to rise above 1%.