John Farrugia spent last Christmas in Dubai, studying merger models.

The chief executive officer of FinnCap Group Plc was just months into his new role as he weighed up potential partners for the London-based firm when he was meant to be on holiday. His deliberations led eventually to a tie-up with Cenkos Securities Plc, announced in March, following unsuccessful talks with another rival.

A sharp downturn in capital markets activity has hit London hard and heaped further pressure on more than 80 firms that shepherd companies through their interactions with investors in the city — a position known as corporate broker.

Some brokers are seeking to diversify revenue streams by deepening advisory services on dealmaking, building out a private markets business or considering a wealth management franchise. For others, the best option is to secure their own merger with a peer.

Corporate brokers are sometimes seen as glorified investor relations, but the relationships can be valuable. Mandates, especially with blue-chip firms, are sought after because they tend to last more than 10 years and can lead to lucrative work if the business raises money or gets involved in a deal.

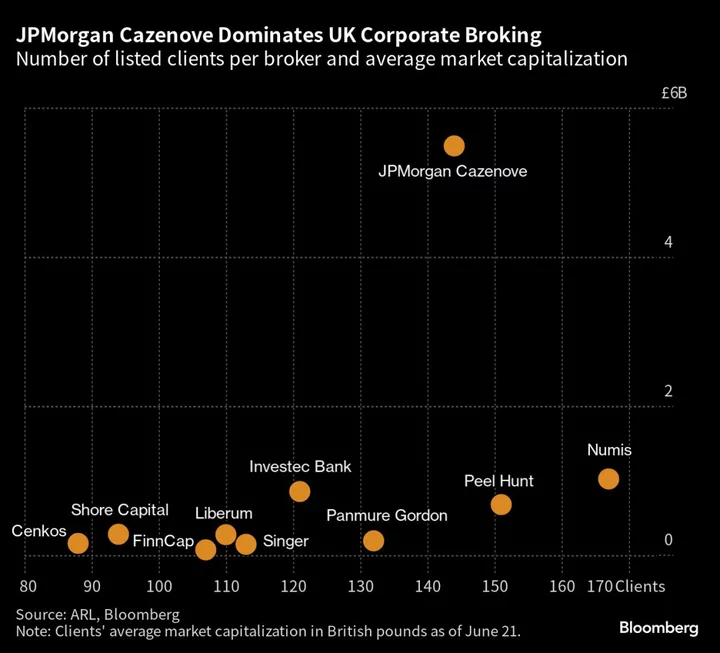

A handful of global banking giants have largely sewn up the biggest clients, but there’s a long tail of smaller firms. Companies on the London Stock Exchange’s growth market, AIM, are even required to retain a broker at all times. Brokers’ responsibilities are, among other things, to constantly assess demand for their clients’ shares and “actively” market them to investors, according to LSE’s website.

‘Maximum Vulnerability’

The most prominent tie-up in the current cycle has been the acquisition of Numis Corp. by Deutsche Bank AG. “We looked at Numis for a long, long time,” Christian Sewing, who runs Germany’s biggest lender, told Bloomberg TV last week.

“We have 170 additional clients with Numis now and we can offer our corporate banking products and at the same time, we have a private bank where I think we can also do the one or the other thing,” Sewing said.

Boutique firms are at a “point of maximum vulnerability,” said Robert Pickering, a former CEO of storied brokerage Cazenove & Co., which is now owned by JPMorgan Chase & Co. “So it’s quite tempting if Deutsche Bank comes knocking on your door.”

With UK initial public offerings at a decade-low and overall trading volumes muted, brokers have seen their revenues plunge since the beginning of 2022. Numis’s profit more than halved to £6 million ($7.6 million) in the six months to March, while rival Peel Hunt Ltd. swung to a full-year loss of £1.5 million.

Recent stock market flops such as retailers Made.com Group Plc and Revolution Beauty Group Ltd. have made it even tougher to bring on new listings. The drought is so entrenched that the government has spent years looking at ways to revive interest in London equities.

Brokers can still generate fees from advising on deals between companies, but activity sputtered out as rising rates put an end to the era of cheap money. And not all brokers have advisory teams large and well-connected enough to get a slice of the few mandates that are coming through.

Corporate “brokers have high cost bases, not least to maintain their capital markets infrastructure,” said Kunal Gandhi, senior managing director at Fenchurch Advisory Partners, which also acts as a financial adviser to London-listed companies.

Hard to Diversify

Support on defense and activism is a particular focus for the industry more recently, according to Matt Smith, head of UK corporate broking at JPMorgan. Fueled by cheap valuations and a slide in sterling since Brexit, UK-listed firms have been targets in a wave of takeover attempts.

Private markets have also come into focus for some brokers, with rising interest rates and a lending squeeze among wary banks prompting businesses to tap other sources of funds. But expanding into the segment requires strong relationships with family offices and private equity firms rather than asset managers, which many equities-focused brokers have yet to build.

Others may look to less cyclical returns in wealth management, given brokers’ long-standing connections to founders. Firms that already offer wealth services alongside broking include WH Ireland Group Plc.

That said, the industry catering to the affluent and super-rich also faces rising costs for regulation, technology and operations. “Diversifying into wealth management is not an inexpensive strategy and not everyone will have the currency to do so organically or inorganically,” said Fenchurch’s Gandhi.

Opening up more IPOs to retail investors is another way some brokers are exploring to try and gain traction. Peel Hunt, alongside peers, plans to relaunch its REX platform under the name RetailBook.

The London-based firm will also be opening a Copenhagen office this summer. The move ensures that sales and research teams gain back unrestricted access to clients in the European Union, Peel Hunt said.

Consolidation Prospects

City brokers have long been the subject of rumors around consolidation.

In practice though, ‘mergers of equals’ are difficult to pull off because of firms’ strong individual cultures and reliance on a small number of key people, according to Pickering, who this year published a book about his time at Cazenove.

Various observers in the industry wouldn’t be surprised to see Panmure Gordon involved in the next potential deal among City firms. The 147-year-old company is controlled by former Barclays Plc CEO Bob Diamond’s private equity vehicle and had been seeking a combination with FinnCap late last year. It made a profit of £3.1 million in 2021, according to its latest publicly available accounts.

Read More:

- London Boutiques Panmure Gordon and finnCap End Deal Talks

- Rathbones Buys Investec UK Wealth Unit in £839 Million Deal

- Deutsche Bank to Buy Numis in Surprise City of London Deal

Many of the pressures on UK brokers are being felt around the world, producing similar deals for smaller investment banks in recent months. Selling to larger lending banks allows brokers to add balance sheet capabilities, while the new owners gain the possibility of cross selling debt and equity products and expanding geographies or sectors to clients.

On the downside, boutique investment bankers might not stick around at a larger firm.

“When a broking business gets acquired by a much bigger bank, top talent might well break away and start again,” said Lorna Tilbian, executive chairman of Dowgate Capital and a founder of Numis. “They don’t really want to be part of huge conglomerates.”

Still, “for some firms, I think the only way to survive is through consolidation,” Tilbian said.

There’s one more possibility for some brokers to keep their independence: a market comeback. However, a rebound doesn’t seem to be around the corner just yet.

London’s biggest listing hopeful so far this year, WE Soda, this month canceled its IPO plans, citing “extremely cautious” investors, particularly in the UK.