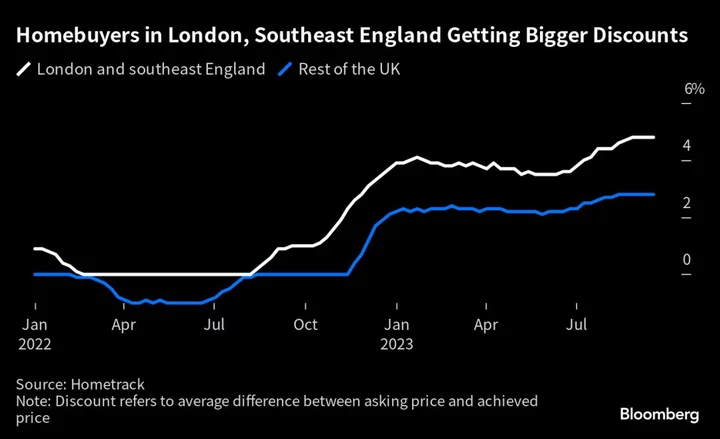

London and southeast England are seeing the biggest UK home discounts as buyers across the country secure the largest price cuts nationwide in almost five years.

The average discount to asking price for a newly agreed home sale was nearly 5% in London and southeast England this month, according to a report from property portal Zoopla. That compared with a 2.8% discount for properties elsewhere in the UK and a national average of 4.2%, the biggest reduction since March 2019.

“House prices are falling the most in London and the south east as higher mortgage rates have the greatest impact on buying power and prices,” said Richard Donnell, executive director at Zoopla. “It’s in these areas where buyers are driving the greatest discounts to asking price to achieve a sale as they have stronger negotiating power.”

Read more: First-Time Home Buyers Can’t Afford to Live in London Anymore

UK households are facing a barrage of cost pressures triggered by pricey borrowing and inflation that’s only slowly dropping back from generational highs. That’s led to a slump in first-time buyer sales, as wannabe homeowners remain stuck in ever-pricier rental contracts while mortgages become more expensive.

House prices in London and southeast England dropped about 1.5% year-on-year in August, compared with small rises in northern regions such as Scotland. Zoopla expects further downward pressure on prices over the next two quarters.

Even London’s luxury housing market, where buyers are less reliant on debt, saw the number of price reductions for deals worth £5 million or more almost double in the year through July. This signals a so-called “buyer’s market”, with UK home purchasers benefiting from 80% more properties for sale than in September 2021, according to Zoopla.

Still, the volume of viewing inquiries from would-be buyers in London and southeast England rose more than 15% in the past three weeks, partly due to a seasonal uptick. Overall inquiries to estate agents are about a third lower than a year ago, but retreating inflation and a pause in Bank of England rate hikes may prompt hopes of cheaper borrowing in the near-term.

Zoopla sees the number of homebuyers increasing once rates fall towards 4.5%, though says this is unlikely until next year. Higher mortgage rates — which are currently averaging over 6%, according to Moneyfacts Group Plc — have reduced buying power by more than 20% compared to early 2022, the report said.

“The modest fall in prices is not enough to improve affordability to a level that will boost activity,” Zoopla’s Donnell said. “Falling mortgage rates are the most likely route to improving housing affordability, and bringing buyers back into the market in the next 12 to 18 months.”