Homesellers in London cut prices more than any UK region in June as surging borrowing costs stretched affordability in the country’s most expensive property market, a survey found.

Asking prices in the capital slid 1.6% from May, according to property portal Rightmove. Nationally, prices were broadly unchanged.

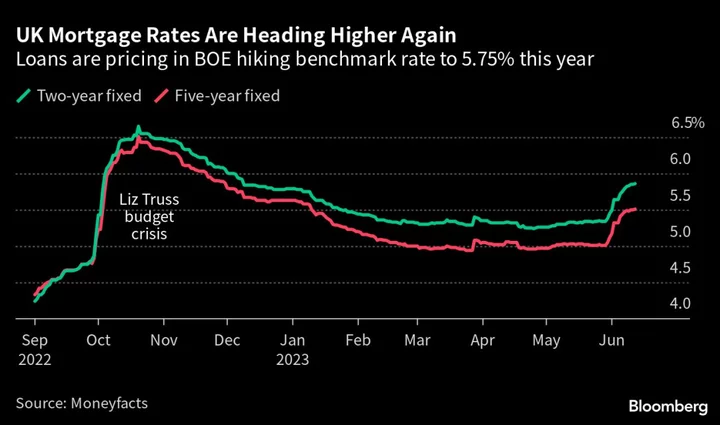

Mortgage rates have jumped this month amid bets that the Bank of England will have to keep raising interest rates to bear down on an inflation rate that remains more than four times the 2% target.

With markets pricing in the possibility that rates could hit 6%, a level not seen since 2001, experts are warning of the risk of a deepening downturn.

This week will be crucial to the outlook, with official figures forecast to show inflation easing modestly from the 8.7% posted in April and the BOE expected to deliver another quarter-point rate increase to 4.75%. There is speculation that officials could opt for a half-point hike if inflation once again proves stronger than forecast.

“We expected some more twists and turns this year and we’ve had several in the last month, including stubbornly high inflation figures, surprisingly large average wage increases, and their eventual impact on mortgage interest rates and availability,” said Tim Bannister, Rightmove’s director of property science.

“We expect that there may be more change to come depending on this week’s inflation figures and the Bank of England Base Rate decision.”

In London, the drop in asking prices was biggest in some of the most expensive boroughs — including Camden and Westminster, where average asking prices are still over £1 million. Areas such as Enfield, Harrow and Newham also recorded significant declines.

While buyers across the country are still keen to purchase — Rightmove said the number of inquiries being lodged with sellers was still up 6% over the last two weeks from 2019’s pre-pandemic levels — agreed sales are down 6%, indicating uncertainty among sellers.

Potential buyers are also becoming more concerned about affordability, as visits to Rightmove’s mortgage-in-principle service shot up 53% after the release of unexpectedly high inflation figures toward the end of May. In the last four weeks, the average mortgage rate for a typical 5-year fixed loan has jumped from 4.56% to 5.2%.

For a new homeowner buying a property at the current average asking price, that would mean an extra £117 ($150) in monthly payments on a 25-year mortgage.

At a national level, the slight £82 drop in asking prices to £372,812 on average was the first decline this year, and the first for the month of June since 2017. Annually, house prices are still growing but that rate slipped to 1.1%.

Bannister said the “belated spring price bounce has quickly turned into an earlier-than-usual summer slowdown.”

But he remained confident that “current trends suggest that our original forecast of a 2% annual drop in asking prices at the end of 2023 is still valid.” That’s not as bleak as some forecasts for actual selling prices.

Agents reported sellers falling into two camps, Bannister said — those who still had over-optimistic price expectations following the buoyancy seen during the pandemic, and those who have more realistic expectations.

Read more:

- Nationwide, Atom Bank Join UK Lenders Hiking Mortgage Prices

- UK Property Surveyors Turn More Positive Despite Rate Rises

- UK Mortgage Lending Unexpectedly Falls After Interest Rate Hikes